NAV in Mutual Funds: Understanding Myths, Meaning, Calculation and What Truly Matters for Investors

Net Asset Value (NAV) is one of the most frequently quoted numbers in mutual fund investing, but also one of the most misunderstood. Many investors believe that a lower fund value signifies cheaper fund shares, are hesitant to invest when the NAV looks “too high,” or panic when the NAV crashes during market corrections.

Table of Contents

ToggleWhat Is NAV and Why Does It Exist

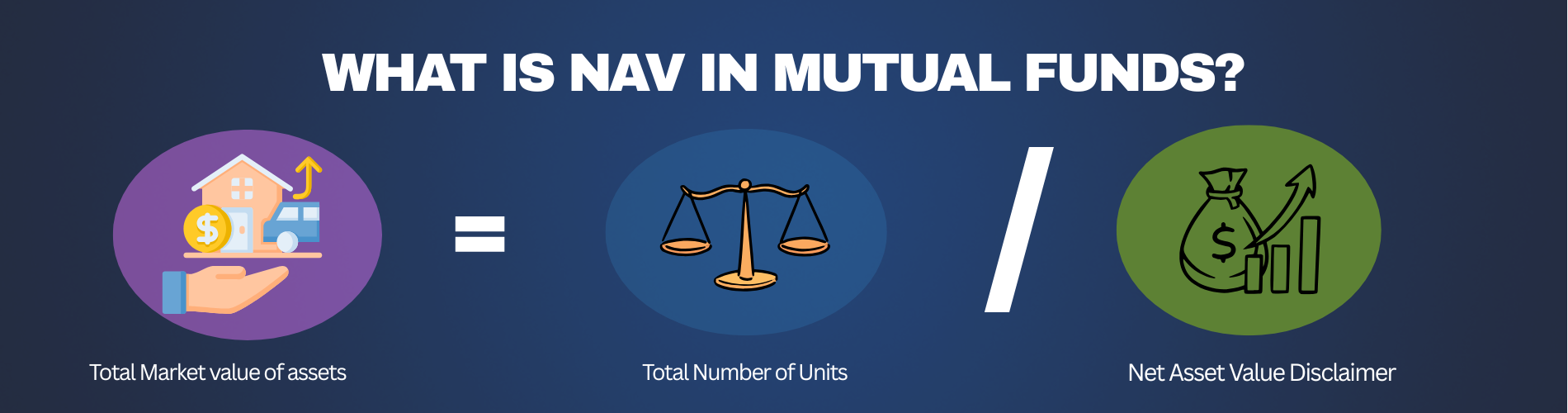

NAV is the price per share of a mutual fund. It is determined by subtracting a fund’s liabilities from its total assets and dividing this figure by the total amount of outstanding units.

NAV formula:

NAV = (Total Assets – Total Liabilities) / Total Outstanding Units

Mutual funds, unlike stocks, do not trade on real-time prices. Their NAV is generally calculated once daily after the close of U.S. or foreign exchange markets (depending on where their securities are primarily traded), but does not involve an assessment of specific security prices and may not use independent sources for pricing, based on the closing prices of securities in the Fund’s portfolio. At this declared NAV, mutual fund units are bought and redeemed by investors; demand and supply do not directly affect it.

The distinction is important: NAV is an accounting result, not a price determined by the market.

What Is NAV: Assets and Liabilities Defined

To understand Net Asset Value properly, it’s also a good idea to understand what goes into its calculation.

Assets

- A mutual fund’s assets include:

- Value of shares, stocks, debentures or money market instruments in the Market.

- Cash and cash equivalents

- Income earned not yet received (dividends and interest receivable)

- Other receivables

These are the values for the close of trading on a given day.

Liabilities

- Fund management and operating expenses

- Distribution and marketing costs

- Outstanding payments and accrued expenses

- Other short-term obligations

The net value is divided by total units, and then, after adjustment for liabilities, the NAV is made available.

Why a High NAV Does Not Necessarily Make a Fund Expensive

One of the longest-lasting myths in investing, and particularly mutual fund ownership that lower NAV is cheaper or has more potential upside. This confusion stems from misusing mutual funds’ comparison to stocks.

Consider two identical funds:

Fund A launched in 2004 at a NAV of ₹10

Fund B launched in 2019 at an NAV of ₹100

Assuming both have the same annual returns, Fund A’s NAV will be higher today simply because of longer compounding. That, however, doesn’t make it costly any more than a lower NAV on a fund makes the fund a bargain. It’s a function of percentage gain to NAV, not the absolute level.

How and Why Net Asset Value Changes Daily

There is a lot of misunderstanding over NAV movements, but they are driven by three simple things:

- Market Movement: When the value of stocks or bonds in the portfolio goes up, NAV increases. NAV decreases when markets go down.

- Expenses: Mutual fund expenses are taken out daily, not yearly. A little bit of a daily drag adds up over time, which is why expense ratios are so critical to long-term returns.

- Dividends and Distributions: When a fund issues dividends, NAV drops by the amount of the payout. That isn’t a loss; the investors got cash instead, and the NAV adjusts down to account for it.

NAV and SIPs: Volatility Is Your Friend

For SIP investors, Net Asset Value volatility is actually in their favour. Units are allotted based on the NAV on the date of investment.

For example:

₹10,000 invested at NAV ₹50 → 200 units bought

₹10,000 at NAV ₹40 → Units bought = 250

In market corrections, the lower fund value help SIP investors accumulate more units. Slowly but surely, this averaging has an enhancing effect on returns as markets rise again, so that timing is less important than consistency over time.

Behaviour during the time of Stock Price Reduction: A Study of Investor Attitude

Steep drops in NAVs can cause investors to panic. Investors watch the value of their portfolios drop and think that something is very wrong.

In truth, NAV is a snapshot of current market prices, not permanent intrinsic worth. NAV’s can fall during general market corrections, even for otherwise fundamentally strong funds.

Investors who redeem solely due to NAV declines often lock in losses, while those who stay invested benefit from eventual recovery. Behaviour, not NAV movement, often determines long-term outcomes.

Net Asset value differences: Open-End, Closed-End and ETFs

Nearly all mutual funds are “open-end” investment companies that will buy back shares at the net asset value.

“Closed-end funds” are companies that trade on stock exchanges, whose market price may be either at a premium or a discount to NAV.

“ETFs” also trade like stocks, so market prices change throughout the day, though NAV is calculated daily for reporting purposes.

Understanding these differences can save investors from getting confused if the NAV and market price ever draw far apart.

When Net Asset Value Actually Matters

Though not necessarily a measurement on which to base fund selection, NAV does matter in certain instances:

Returns calculation: All mutual fund returns are calculated from the change in NAV.

Tax: Capital gain tax is applicable on the purchase NAV and the redemption NAV.

Exit load: If any redemption is made on or before a period of one year (non-lock-in period), an exit load shall be deducted from the redemption value based on the NAV.

In these scenarios, NAV is more of a reference than an indicator of performance.

What Investors Should Watch Instead

Instead of looking at whether a fund’s NAV is high or low, the key question investors should ask themselves is:

- Consistency across market cycles

- Risk-adjusted returns

- Portfolio quality and diversification

- Expense ratio efficiency

- Fund manager discipline

- Match with financial objectives and time frame

These considerations are much more indicative of long-term success than NAV levels.

The Bottom Line

Net asset value is a critical number, but it is frequently misused and overvalued. It tells you what a fund is worth today, not whether it’s a good or bad investment.

A high Net Asset Value does not put a lid on future returns, and a low one does not ensure the fund will grow. What really does matter is the quality of the portfolio and risk management, and whether you are good enough to stick with it through stressful markets.

Net Asset Value in mutual fund investing is a mirror, meaning it reflects value. It is not a compass leading to returns.

Also Read: Indian Stock Market Today: 8 Optimistic Things to Know as Sensex, Nifty Face Weak Global Cues