Indian IT Stocks Slides: Infosys, TCS, other IT stocks down upto 6% as AI Disruption Fears Ignite Global Tech Sell-Off

As someone who closely tracks markets, days like these immediately grab my attention. When the Nifty IT index cracks nearly 6% in a single session, sliding to the 36,300–36,400 zone, and frontline Indian IT stocks decline together, it’s not just another volatile trading day; it’s a signal worth decoding carefully.

Table of Contents

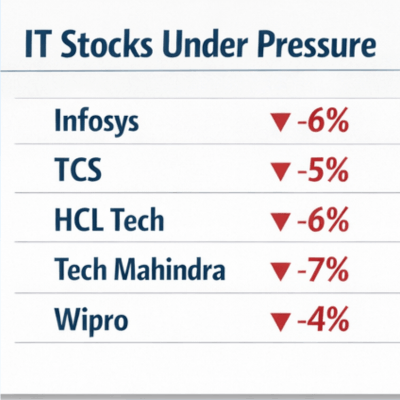

ToggleOn Wednesday morning, Indian IT stocks were under sharp pressure. Shares of Infosys, TCS, HCL Technologies, Tech Mahindra, Persistent Systems, LTI Mindtree, Coforge, and Mphasis were down between 5% and 7%, while Wipro declined over 4%. Even Info Edge (India), the parent company of Naukri.com, fell close to 5% in early trade.

What stood out to me was that this sell-off was not driven by company-specific bad news. Instead, it was fear, global, thematic, and centered around one word that has dominated markets for over a year now: Artificial Intelligence.

In this article, I explain why Indian IT stocks declined sharply in a single trading session, the role played by fears of disruption driven by artificial intelligence in that selloff, and whether it is just panic selling or signals a shift in value for companies in the IT sector.

The Trigger: A Global Tech Sell-Off Fueled by AI Anxiety

Indian IT stocks did not fall in isolation. The weakness clearly spilled over from Wall Street, where technology and software stocks saw aggressive selling in the previous session. Global investors grew uneasy after fresh developments in artificial intelligence raised questions about the future of traditional software and IT services businesses.

The immediate trigger was the launch of advanced automation tools by AI developer Anthropic, including plug-ins for its Claude AI agent that can automate workflows across legal, marketing, sales, and data analysis functions. These are the areas where IT services, both global and Indian companies, have historically generated stable and recurring revenues.

As concerns intensified, US tech stocks reacted sharply in response. Many other AI and software luminaries sold off significantly, helping drag the tech-heavy Nasdaq down. Historically, whenever US technology stocks are under pressure, share prices of Indian IT companies take a hit too because they have deep exposure to overseas clients, particularly in North America, which accounts for more than 55 per cent of total revenue for most large Indian IT players.

Why Indian IT Stocks Reacted So Sharply

From my perspective, the fall in Indian IT stocks can be attributed to three overlapping issues that coincided at the same time.

1. AI Disruption vs Traditional IT Services Models

Indian IT companies have long thrived on large-scale service delivery models that rely on human capital. Key sources of revenue are application development and support, enterprise software license fees, BPO, maintenance, and data analytics.

The rapid advancement of AI tools capable of automating research, analysis, coding assistance, and decision-making has unsettled investors. The fear is simple but powerful: AI can perform more work with fewer people, so the traditional billing model that depends on headcount and hours could face new pressures.

Whether this fear materializes fully or not remains to be seen, but markets are quick to price in uncertainty.

2. High Valuations Leave Little Margin for Error

Another reason behind the sharp correction is valuation comfort, or rather, the lack of it. Despite muted revenue growth over the last few quarters, many frontline IT stocks continue to trade at premium valuations compared to long-term averages.

When there’s rising uncertainty, the expensive stocks are typically the first to be sold. In such situations, even a small negative trigger can lead to 5–7% single-day corrections, as we witnessed in this session.

Market experts have also pointed out a lack of solid fundamental support for a prolonged rally in the near term, as long as valuations remain high and unless earnings growth meaningfully picks up.

Also Read: Wipro Q3 FY26 Results: Revenue Growth Holds Steady as Profitability Feels the Heat

3. Strong Dependence on Global Cues

Among all sectors in India, IT remains one of the most globally sensitive. Revenue visibility depends heavily on:

- US and European enterprise technology spending

- Global macroeconomic conditions

- Overseas hiring and discretionary tech budgets

So when global software companies fall on fears of AI-led disruption, Indian IT stocks tend to react almost immediately, regardless of domestic economic stability.

Info Edge’s Decline Signals Job Market Concerns

The fall in Info Edge, the parent company of Naukri.com, further complicates the narrative with a nearly 5% drop. Its downtrend is an indication of escalating concerns around the IT and white-collar job economy.

If AI adoption accelerates faster than expected, companies may slow hiring, automate entry-level tasks, and reduce dependency on large service teams. Even the perception of job disruption is enough to weaken sentiment, especially in a sector that employs millions in India.

Panic or Structural Shift? My Take

This is the most important question investors should be asking right now.

In my view, the current sell-off appears to be driven more by fear and uncertainty than by confirmed structural damage. AI is disruptive, most certainly, but disruption does not necessarily lead to obsolescence.

Indian IT service companies have made successful transitions several times in the past, from Y2K services to cloud computing and digital transformation. Every stage encountered skepticism, but the industry leaders adjusted and emerged stronger.

AI would eventually become a productivity enhancer and margin booster if companies use it to make their internal operations more efficient, go up the value chain, and deliver tailored enterprise-type solutions rather than commoditised services.

Also Read: The Hidden AI Trade: How 2 Indian Mid-Caps Are Monetising the Infrastructure Boom

What I’m Tracking as an Investor

I’m not getting caught up in the emotional reactions to short-term price movements, instead I am looking at a few key signals:

- What management is saying about AI adoption on earnings calls

- Deal wins tied to AI transformation and automation

- Changes in hiring patterns and employee utilization rates

- Shifts in revenue mix toward higher-value services

These factors will provide clearer signals than daily stock price fluctuations.

How Retail Investors Can Approach This Phase

For long-term investors, I do not view this correction as a reason to panic-sell fundamentally strong IT companies purely based on headlines.

At the same time, this may not be the phase to aggressively chase dips without selectivity. Quality, balance sheet strength, and adaptability will matter more than ever.

Personally, I prefer companies that are proactively investing in AI capabilities, maintain strong client relationships, and demonstrate the ability to evolve their business models with changing technology cycles.

Final Thoughts

The sharp fall in Indian IT stocks is less about today’s earnings and more about tomorrow’s uncertainty. Artificial intelligence is forcing markets to rethink productivity, employment, and competitive advantage across the technology landscape.

Short-term volatility is inevitable. Over the long term, adaptability will determine winners. As always, clarity does not emerge on red market days, but in how companies respond once the dust settles.

Also Read: Indian Stock Market Today: 8 Optimistic Things to Know as Sensex, Nifty Face Weak Global Cues

Disclaimer

This article represents my own opinions and should only be used for informational purposes. Nothing in this article may be considered as financial or investment advice. Stock market investments are subject to risk. Readers are advised to consult a qualified financial advisor before making any investment decisions.