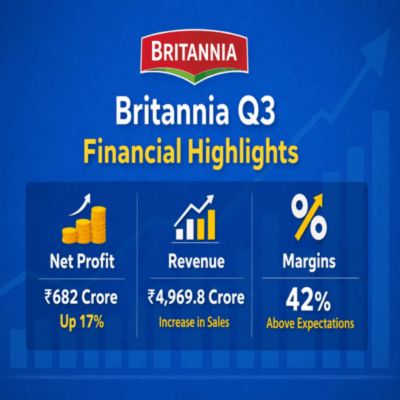

Britannia Industries Profit Jumps 17% After Q3 Results

Whenever I follow the FMCG sector, Britannia Industries always catches my attention. Its shares were trading 4.6% higher at Rs 6,156 per share in early Wednesday after the company reported Q3FY26 numbers today. As an investor who peers not only at the numbers but also at growth trajectories, customer appetite, and management strategies, this was a critical moment to dig into why the stock is moving and what its results indicate about how the firm’s operations are advancing.

Table of Contents

ToggleThis article covers Britannia’s Q3 FY26 results on net profit, revenue growth, and operational performance, and shares insights from brokerages such as Nomura and Motilal Oswal. It discusses what is driving growth in both the biscuits and adjacent categories, including pricing normalisation post GST. I also discuss what implications these findings could have for investors looking to add Britannia to their portfolio.

Britannia Q3 FY26: The Numbers That Caught My Eye

As I delved into the numbers, a few things stood out immediately. Britannia reported a consolidated net profit of Rs 682 crore for the third quarter, a 17% increase compared to Rs 582.3 crore in the same period last year. Revenue from operations rose to Rs 4,969.8 crore, up from Rs 4,592.6 crore a year ago, indicating consistent performance even in tough market conditions.

There is one metric that I always look at, which is growth momentum. Even as the biscuit industry adopted a price-stable strategy after the GST rate reduction, Britannia’s business increased by about 12% in November and December on robust demand for its flagship brands like Marie Gold and Good Day. To me, this shows not just the strength of the brand but the effectiveness of the company’s marketing and distribution plan.

I also noted that the gross profit margin exceeded expectations by 42%, thanks to benign input costs. This margin expansion is important to me, as it demonstrates Britannia has the ability to remain profitable even when trading conditions are changing. It makes me feel more confident that the company’s earnings come not only from fleeting cost advantages but also from structural efficiencies.

Why the Numbers Excite Me

One of the reasons I am very bullish about Britannia is not its profit growth and revenue stability but the focus on operational efficiency. Q3 numbers indicate that Britannia can leverage both cost pressures and pricing right, something critical in FMCGs where margins can get crushed very easily.

Moreover, the company’s growth across adjacent categories beyond biscuits is a positive sign. I like to see diversity in revenue streams because it can help minimise dependence on one product line. For Britannia too, product launches in cakes, dairy snacks, and health-focused biscuits are aiding top-line growth. For me, this indicates that they’re preparing not only to stay with future consumer trends but also to dominate the core biscuit business.

Expert Opinions I Follow Closely

Brokerage insights are helpful for me to compare my personal thesis with professional analysis.

Nomura’s Take:

Nomura continued to have a ‘Buy’ rating on Britannia with a target price of Rs 7,000 per share, indicating an upside of more than 19% from the previous closing price. They added that Q3 volume growth was mostly as expected, but with higher margins. This is in line with my observation that Britannia is doing a good job on cost control and yet maintains high levels of sales momentum.

Motilal Oswal’s Take:

Motilal Oswal highlighted that while revenue slightly missed their estimate, EBITDA was above expectations. They noted that November and December growth was primarily a result of continued media investment and brand innovation. I personally find this encouraging, the fact that the company isn’t resting on its laurels; instead, they are focusing hard on marketing and innovation to encourage consumer engagement.

Also Read: ELSS Tax Saver Funds in 2026: Motilal Oswal, SBI and HDFC Funds Explained for Long-Term Investors

Why I’m Personally Bullish

I prefer companies with brand power, operational efficiency, and strategic foresight. Britannia ticks all these boxes. I like that it has strong performance from biscuits and the surrounding categories, good margins, and revenue growth, which makes me believe in its long-term future.

I also consider demographic trends. India’s urban population is expanding, and so is the demand for packaged food in tier-2 and tier-3 cities. Britannia is well-placed to capitalise on this trend. It has a strong distribution set-up, so availability is not much of an issue, and high-decibel marketing leads to some brand recall as well. For that reason, I’d say Britannia is one to watch.

My Take on Risks

Despite those strong numbers, I remind myself that no stock is risk-free. For Britannia, I watch for:

- Fluctuating commodity prices, which could impact margins.

- Proposed regulatory changes that may impact the FMCG and processed food sectors.

- Growing competition from other biscuit and snack makers, both domestic and international.

And it’s with these risks in mind that I tell myself to stay disciplined and not to get overconfident even when the quarterly results are good.

For me, these numbers indicate that Britannia is not just performing well in one-off quarters, but it has growth momentum to carry forward, and this is one of the most important points to be considered when we invest for the long term in any FMCG company.

Final Thoughts: Why I’m Watching Britannia Closely

I believe Britannia is a unique fusion of brand strength, operational efficiency, and consumer trust- attributes not easy to find in the FMCG space. Q3 FY26 results only underpin my conviction that the company is a long-term growth story, given marketing, innovation, and foray into adjacent categories.

I will continue to track quarterly updates, input costs, and market trends to refine my investment strategy. At this point, numbers, the brokerage tips, and growth momentum make me personally bullish on Britannia with caution about possible risks.

Disclaimer

This article is for informational purposes only and does not constitute investment advice, nor an offer to buy or sell a security. It’s not financial advice. Please make sure to work with a licensed financial professional before making any investment decisions.