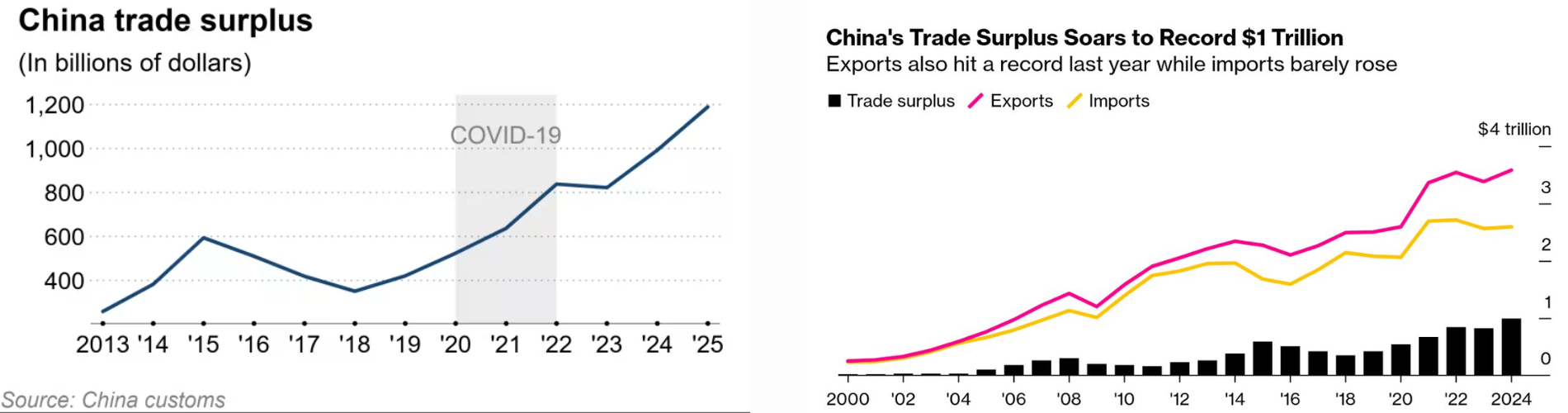

China Trade Surplus Soars $1.19T: Key Strong Market Insights

China’s economic milestones are always worth noting, but when Beijing reported in early 2026 that it had racked up a record $1.19 trillion trade surplus in 2025, heads didn’t just turn; they got me thinking long and hard about the future of global trade flows, investment patterns and geopolitical hazards.

Table of Contents

ToggleIn this article, I’ll explain what this means from an investor’s perspective, why it matters far beyond Beijing and how you too can navigate the evolving terrain with clarity in mind.

What Happened?

Put simply, China’s trade numbers for 2025 smashed historic records. Exports surged, imports lagged, and the overall trade balance ballooned to levels equivalent to the GDP of a mid‑tier developed economy. When I first saw the figures, my immediate reaction wasn’t just amazement; it was pondering why this happened and what it signals next.

Here’s the short version:

- Exports continued to grow even as domestic demand weakened.

- China diversified its export markets away from the U.S. to Southeast Asia, Africa, and Europe.

- Consumer tech, machinery, and rare‑earth elements remained in strong global demand.

- Trade tensions, particularly with the United States, kept shaping the flow of goods.

This is more than just data, it’s a story of strategy, resilience and adaptation.

Diversification: China’s Strategic Export Pivot

One of the most striking things about the 2025 numbers is how much China has diversified where it sells its products.

In previous years, heavy dependence on the United States as a destination meant that trade policy and tariffs threats from Washington had an outsized effect on China’s export outlook. But in 2025, exporters instead looked outward, to ASEAN countries, Africa and Latin America, as well as the EU.

From where I sit, this shift is significant for two reasons:

- Market Risk Management: China has detached itself from disruptions in individual markets through distribution of its demand over multiple zones.

- Emerging Demand: Economies in Southeast Asia and Africa are undergoing rapid urbanisation, fuelling the need for infrastructure, technology and consumer goods.

This isn’t just statistic‑watching; it’s the market adapting, and investors should take note.

Weak Domestic Demand

Here’s where the story gets more complex. China’s export boom isn’t only a victory lap; it’s also a symptom of weak domestic consumption.

In a healthy economy, robust internal demand balances external sales. But China’s property sector has been weak, household savings rates have increased, and consumer spending hasn’t bounced back as strongly as its leaders had hoped.

From an investor’s perspective, this matters because:

- External demand can be volatile and tied to global cycles.

- Domestic consumption is a more stable engine of growth.

- Overreliance on exports may mask underlying weaknesses.

When I analyse China’s macro position, I often say: a surplus looks strong on paper, but the engine driving it matters even more.

The Geopolitical Layer: Trade Surplus vs. Trade Relations

Investment decisions never occur in a vacuum. The geopolitical backdrop, especially U.S.-China tensions, is a defining factor.

Even with strong trade figures, relations with the U.S. continue to cast long shadows. Tariffs, technology restrictions and trade policy uncertainties remain. And it not only economical but also trust, supply chain and strategic dimensions. I view China’s trade surplus under expansion not just as economic numbers, but also as geopolitical means of pressure.

One thing I monitor closely as an investor: How trade surpluses shape diplomatic stances and vice versa. For example, strong exports to Africa, for instance, are not only commercial but also tied to infrastructure deals, development financing and long-term relationships that have the potential to reshape global influence over decades.

Currency, Stocks, and Markets: What the Numbers Triggered

When the surplus figures hit, markets reacted in real time:

- China’s equity indexes rose as sentiment improved.

- The yuan was steady, suggesting confidence in the currency’s role in global trade.

- Foreign direct investment flows indicated a resurgence of interest in China’s tech and manufacturing industries.

From my analysis, these market reactions point to one conclusion: Investors are pricing in China’s adaptability, even amid structural headwinds.

But I always caution: markets can overshoot. What rallies one quarter reverse the next if fundamentals don’t match investor expectations.

Supply Chain Shifts: Not Just Numbers, But Real World Changes

Beyond the headlines, the 2025 surplus is a sign of real shifts in how global supply chains are being arranged:

- Multinationals are creating production hubs around ASEAN markets.

- Chinese factories are expanding their assembly and processing operations outside of China.

- Trade routes and tariff policies are being restructured.

For investors, the takeaway is clear: supply chains now double as investment signals. A cheaper good moving through multiple countries isn’t just logistics; it’s a recalibration of economic geography.

Also Read: Trump’s Iran Tariff Puts India’s $1.2 Billion Exports Under Watch

What This Means for You

I won’t sugarcoat it: China’s record surplus is a double‑edged sword.

Bullish Aspects

- Evidence of China’s adaptability and export competitiveness.

- Diversification of markets reduces concentration risk.

- Continued demand in tech, machinery, and rare‑earth exports.

Cautionary Signals

- Weak domestic consumption isn’t going away overnight.

- Trade imbalances can invite protectionist policies.

- Geopolitical risks could amplify volatility for foreign investors.

In plain terms: there’s opportunity here, but it requires nuanced positioning.

Strategic Thinking for Investors: My Suggestions

If I were advising a portfolio strategy inspired by these developments, here’s how I’d frame the thinking:

- Do not treat China as a monolith. Different sectors have very different growth prospects.

- Zoom out from short‑term market reactions. Look at structural drivers over 3–5 years.

- Watch policy signals closely. Beijing’s regulatory shifts can move markets faster than economic data.

- Balance exposure with risk hedges. Diversification across regions and sectors still matters.

This isn’t an investment playbook, but it’s the mental framework I use when I look at these figures every quarter.

Final Thoughts: What I’m Watching in 2026

As we get further into 2026, here are the signs I’ll be tracking:

- Beijing’s efforts to stimulate domestic consumption.

- The evolution of U.S.-China trade policy and tariff decisions.

- Changes in flows of foreign investment into Chinese tech and manufacturing.

- How China’s trade surplus impacts global imbalances and currency dynamics.

For anyone serious about macro‑based investing, this isn’t just numbers; it’s the shape of the next decade.

Also Read: European Markets Set To Open Higher Amid Geopolitical Focus

Disclaimer

This article reflects my personal analysis and insights for educational purposes only. It should not be considered financial advice. Always consult a qualified financial professional before making investment or trading decisions.