India’s GDP Slows to 6.4% — Why This Moderate Growth Is Still Promising

If you’ve been reading the economic news lately, no doubt you saw the headline: India’s GDP is expected to rise by about 6.4 percent in this fiscal year, down from a rise of 8.2 percent last year.

Table of Contents

ToggleAt first glance, this feels like a sharp decline. Many readers and investors immediately worry: Is the economy heading for trouble?

Here’s what I think: the headline number tells only part of the story. In this article, I’ll break down why growth is slowing, which sectors are leading or lagging, what the numbers actually mean, and how investors can respond. I’ll also explain why this slowdown isn’t a crisis, but rather a predictable stage in an economy that’s changing at lightning speed.

A Drop in Growth Doesn’t Mean the Economy Is Weak

A decline from 8.2% to 6.4% sounds alarming. But context matters. India’s long-term average GDP growth hovers around 6–7%, so even 6.4% keeps India among the fastest-growing major economies in the world.

Consider it this way: When an economy is rebounding from tremendous growth, as India did post-pandemic, moderation is to be expected. It’s rare for an economy to maintain near double-digit growth year after year. A drop in the rate of expansion is often evidence of a healthy recalibration, not necessarily a collapse.

Why Growth Is Slowing

From my perspective, three key factors explain the moderation:

1. High Base Effect

Last year’s 8.2% growth creates a high benchmark. So if output keeps going up in absolute terms, it will, of course, seem to be rising more slowly as a percentage.

2. Global Economic Conditions

Global growth is slowing, and demand from large trading partners has eased. This impacts exports, manufacturing and foreign investment. And while the Indian economy is healthy domestically, global headwinds still exert a pull on the headline numbers.

3. Transition to Sustainable Growth

India is transitioning from growth driven by recovery to expansion led by productivity . That’s a structural change, one that frequently shows up in the data as slow growth in short-run indicators, but it’s an indication of maturity rather than vulnerability.

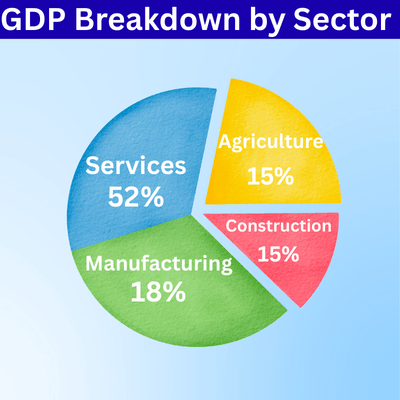

Breaking Down GDP: Not All Sectors Are Slowing

GDP is an aggregate figure. To truly understand the economy, you have to look sector by sector.

- Services: The services sector accounts for about 50–55% of GDP and is growing consistently, led by IT, finance and professional services. Digital adoption and rising demand for tech services have supported activity.

- Construction and Infrastructure: The government capex is higher by around 10–11%, which will nourish the construction and real estate.

- Manufacturing: Growth has slowed, but the manufacturing sector is still expanding. Some sectors, like cars and consumer electronics, have hit the brakes because their global supply chains were broken.

- Agriculture: About 15–16% of GDP; agriculture has recovered from previous ups and downs, and has kept rural incomes stable and consumption up.

I view this unequal slowdown as evidence that the economy is changing, not failing.

Consumption Remains a Strong Anchor

One of my key points here is that private consumption makes up more than 55% of India’s GDP. The ways we consume tend to provide signals, or warning flags if you will, of economic stability or fragility.

Currently:

- Urban consumers are choosing to spend carefully on what is essential and services.

- Rural consumption has also rebounded, fuelling demand for sectors including FMCG, telecom and transportation.

- Employment-linked sectors, particularly construction and services, continue to generate income, maintaining purchasing power.

Investment Activity Supports Growth

Investment, measured as Gross Fixed Capital Formation (GFCF), accounts for nearly 30% of GDP. This includes spending on machinery, factories, and infrastructure.

Here’s what I find encouraging:

- Government infrastructure spending is still growing at double-digit rates, adding jobs and fuelling domestic demand.

- Private sector investment has weakened a bit, but it is far from frozen in place.

- Emerging sectors, including renewable energy and technology manufacturing, are still receiving capital.

Numbers such as these suggest that the economy is constructing long-term strength, not merely drawing down short-term consumption.

Fiscal Discipline and Inflation Stability

Macro stability is another reason I’m not worried:

- The fiscal deficit is being phased out.

- Inflation remains manageable, so real incomes and spending power are intact.

- Currency and financial markets remain stable, reducing the risk of sudden shocks.

I find these buffers reassuring that the economy can absorb slower growth without going off course in the longer term.

Investor Takeaways from a 6.4% Growth Rate

So what does this mean for investors? From my perspective:

- Moderate growth is the best for steady, long-term investment rather than chasing short-term returns.

- Domestic consumption and infrastructure-linked companies are likely to outperform export-heavy firms in the short term.

- Digitalization, infrastructure and urbanization are among the long-term drivers of growth.

- Volatility could recede as the economy restarts aspects of normal activity, and windows may open for more patient investors.

It’s not yet time to panic, but it is a time to diversify and plan.

Putting 6.4% Growth in Perspective

Historically, India’s economy has averaged 6–7% growth over the long term. Even with a slowdown to 6.4%, India remains far ahead of many developed economies, where growth struggles to reach 2–3%.

To give readers a benchmark: real concern arises only if:

- GDP falls below 5%, or

- Investment drops below 25% of GDP

Neither scenario is occurring. In my view, this slowdown is a normal adjustment, not an alarming contraction.

The Long-Term View Still Looks Strong

Looking ahead, India’s growth drivers still appear strong in the longer term:

- Demographic dividend: a large, young, and increasingly skilled workforce

- Urbanization and growing infrastructure, supporting jobs and demand

- Digital adoption, boosting services and productivity

- Targeted government spending, encouraging private investment

While they may be a moderating influence at least in the short term, they combine to ensure that the underlying growth trajectory is well above global averages.

Final Thoughts

A 6.4 per cent GDP growth rate is not a warning; it’s an era of India’s economic history. Slowdowns are normal after torrid expansions and offer an opening to solidify fundamentals.

As far as I’m concerned, that headline number should be an incentive to plan thoughtfully, invest intelligently and wait. For investors, policymakers and businesses, this is a moment to focus on quality growth and sustainability, not panic about some headline.

Also Read: India’s GDP growth slows to 5.4% in Q2 FY25 due to weak consumption.

Disclaimer

This article is for informational and educational purposes only. The views expressed are personal and should not be considered financial or investment advice. Readers should evaluate their own financial situations or consult a qualified professional before making investment decisions.