Kwality Wall’s Shares Jumps 5%: Why Investors Are Optimistic

As someone who watches markets with both fascination and caution, I always pay attention when a major corporate action unfolds, especially one involving a household name. When Kwality Wall’s made its much-anticipated debut on the Indian stock markets, it wasn’t just another listing on the NSE; it was the result of a strategic move by Hindustan Unilever (HUL) that has far-reaching implications for investors like me.

Table of Contents

ToggleIn this article, I’ll share my personal take on why the stock initially struggled, what factors led to its first green close, the mechanics of the HUL demerger, the impact of Magnum’s open offer, and what it all means for investors, including strategies I personally consider when evaluating such stocks.

First Impression: A Rollercoaster Debut

When Kwality Wall began trading, it was tough to ignore the initial discount at the listing price, significantly below expectations. Markets, as we all know, reflect sentiment as much as fundamentals, and the early dip clearly showed hesitation among investors.

I remember thinking, “Is this an overreaction or an opportunity?”

Later in trading, the share rose to its highest level so far, before settling lower. Watching that intra-day volatility, I couldn’t help but reflect on how markets sometimes price uncertainty more than actual business potential.

The 5% Jump: What Really Happened

After an initial period of uncertainty, I saw that the stock had finally rallied about 5%, and went on to close in the green for the first time since it hit the market. This wasn’t just a technical bounce, though, in my view; it suggested a more subtle change in investor sentiment and market confidence.

There were a few factors that seemed to contribute to this 5% gain:

- Investor digestion of the demerger: After investors realised how HUL’s shareholders would be receiving Kwality Wall’s shares, they stopped thinking and started buying.

- Attractive valuation: The early listing discount made the stock look too cheap to its standalone prospects, and investors stepped in.

- Strategic signal from Magnum’s open offer: Seeing a major industry player acquire a significant stake at a discount reassured the market that the business had solid backing.

To me, seeing the 5% surge made it seem like we had shifted from short-term fear to cautious optimism, with the market starting to judge the ice-cream business on its own merits.

What Changed After the Initial Debut?

The stock’ssubsequent jump wasn’t simply a random spike. For me, several factors played into this:

- Investor digestion of the demerger news: It usually takes a few sessions for the market to digest structural corporate changes.

- Clearer valuation perceptions: In the immediate wake of the shock, investors started evaluating the ice-cream business discretely.

- Broader market sentiment turning positive: If main indices stay flat or edge higher, even speculative stocks can rally.

Investing is as much a psychological game as it is a numbers game, and in this case, the buyers decisively won the day.

Understanding the HUL, Kwality Wall’s Demerger

HUL announced the demerger of its ice-cream division, the business behind beloved brands such as Kwality Wall’s, Cornetto, and Magnum. As a consumer and investor, I was personally intrigued by this. Splitting such a well-known FMCG brand from its parent is no small decision.

The rationale was simple: this segment, though popular, accounted for only a small portion of HUL’s overall revenue. As part of a giant FMCG portfolio, it was a smaller player; as a standalone entity, it could potentially attract focused growth capital and deliver clearer financial performance.

So, in my view, the demerger wasn’t just corporate restructuring; it was an opportunity for investors to value the ice-cream business on its own, finally.

Also Read: Britannia Industries Profit Jumps 17% After Q3 Results

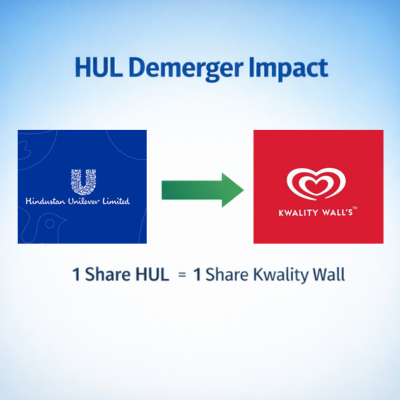

The Mechanics: How Shares Were Distributed

Here is how the share distribution functioned, and why it is important:

- Demerger ratio: Investors were given 1 share of Kwality Wall’s for every HUL in their holdings at the record date. This 1:1 ratio was a straightforward but weighty decision; it implied that HUL shareholders suddenly became co-owners of the new company without having to pay anything over and above.

- Record and allotment process: HUL’s shareholders, whose names were included on the register as on the record date, became eligible to receive Kwality Wall’s shares following the de-merger.

From personal experience, such corporate actions can sometimes get lost in the day-to-day workflow of a retail investor. But with a 1:1 entitlement, there was no ambiguity, and that’s a key reason why the market slowly found its footing after the initial noise settled.

Magnum’s Open Offer: A Subtle Market Signal

Amid all this, another development caught my attention, The Magnum Ice Cream Company’s open offer to acquire 26% stake at a price below listing levels. This was about a 28% discount from the initial trading price and seemed to take many by surprise.

Open offers at a discount often suggest strategic repositioning or share consolidation. For some investors, that’s bearish; for others, including myself, it flags long-term intentions rather than short-term speculation.

I remember reading the offer and thinking: “If a major industry player is willing to hold a large stake even at a discount, they see intrinsic value that the market might be missing.”

This kind of strategic signal can shape sentiment over weeks, and in this case, it likely contributed to the gradual shift toward a green close.

What This Means for Investors

So what’s the takeaway from all this, especially for someone like me who looks at trends and trades with a blend of patience and pragmatism?

- This isn’t just a short-term bounce: The gain hasn’t necessarily reversed the stock. What-now is rather a recalibration of risk perception; what has changed is that investors are now pricing in structural clarity from demerger.

- Valuation still matters: The early discounting and open offer pricing indicate that the market is wary. That means valuation, not emotion, will likely dictate this stock’s trajectory over the coming months.

- Corporate intent is a signal: Magnum’s stake acquisition tells me someone with deep industry experience still believes in this business. For long-term investors, that’s encouraging.

My Strategy Going Forward

I asked myself: “Do I view this as a short-term swing or a long-term value play?”

And my answer has been:

- Hold sufficient exposure to participate in the upside if fundamentals strengthen.

- Monitor quarterly performance carefully, especially revenue growth and margin trends.

- Watch institutional interest; smart money flows first and often indicates a commitment.

Also Read: Cochin Shipyard Surges 6% After a Strong ₹5,000 Cr Bid

Disclaimer

This article is for informational and educational purposes only, and should not be taken as investment advice. Equities are subject to market risk and loss of principal. Be sure to do your own due diligence or speak with a qualified financial adviser before making investment decisions.