Trump Tariffs Could Threaten $86B India-U.S. Trade

The Trump tariff regime has been under review by the U.S. Supreme Court. When I first started following, I thought it would be another Washington legal tussle. But over the past year, this issue has transformed into one of the most consequential economic policy battles of our time, one with implications that span legal doctrine, global markets, and the very future of trade.

Table of Contents

ToggleThis article talks about why the Supreme Court case is so significant, how it could reshape global economics, particularly for Indian markets and what I’m watching as the Supreme Court prepares its ruling

The Core Question: Presidential Power vs. Congressional Authority

At its heart, the Supreme Court case isn’t just about tariffs, it’s about who holds the power in a constitutional republic. The U.S. Constitution clearly gives Congress the authority to levy taxes and regulate commerce. But President Trump’s administration sought to sidestep that by using the International Emergency Economic Powers Act (IEEPA) a 1977 statute meant for national emergencies, to impose tariffs on nearly every trading partner. This move raised questions about broad executive power versus legislative authority on trade.

Even conservative justices on the Supreme Court have been sceptical of this expansive interpretation. During oral arguments, several justices pressed the government’s lawyer on whether the president could, under this logic, have unchecked tariff authority, a power that many argue should rest with the legislature.

In my view, this challenge is not ideological theatre, it goes straight to the foundations of the separation of powers. If the court upholds the administration’s position, it could set a precedent for future executives to use emergency laws to override Congress on major economic issues.

What Lower Courts Have Said About Trump Tariffs

Before the Supreme Court weighed in, multiple lower courts found that tariffs imposed under IEEPA were likely unlawful because the law was never designed to authorise sweeping tariffs, especially those with a multi‑billion‑dollar economic impact.

If the Supreme Court reprises this interpretation, it may strike down tariffs that have thus far raised substantial revenue. From where I sit, that’s a sign that lower courts are already beginning to challenge the reasoning of the tariffs and that in time what the Supreme Court chooses to do on these interpretations could have big consequences.

The Economic Stakes of Trump Tariffs: Revenue & Market Risk

Trump Tariffs are important because billions of dollars have been collected by the federal government in disputed tariffs since early 2025, and up to four significant revenue streams hinge on the legal front that is now before the Supreme Court.

If the court strikes down the IEEPA basis for tariffs, existing duties could be invalidated, and U.S. importers could seek refunds of potentially tens of billions of dollars already collected a major risk for fiscal projections and corporate balance sheets.

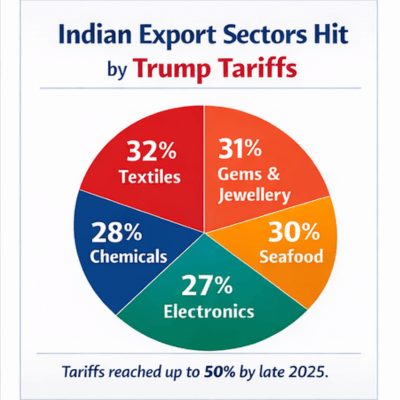

For Indian trade specifically, the numbers paint a stark picture:

- India exported about $86.5 billion worth of goods to the U.S. in FY2025, making the U.S. its largest export partner.

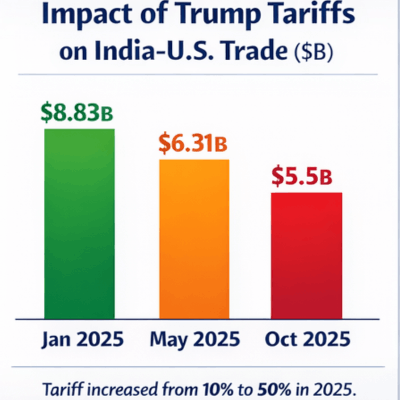

- Aggressive Trump tariff hikes from roughly 10% earlier in the year to as much as 50% by late 2025 coincided with a 28.5–37.5% drop in Indian exports to the U.S. between May and October 2025, according to industry research.

- Over that period, exports slid from $8.83 billion to $6.31–$5.5 billion, a sharp contraction in just a few months.

These are not marginal shifts they reflect billions in lost trade and underscore just how much tariff policy can swing revenue flows. From an investor’s perspective, that means:

- U.S. producers who benefited from protectionist levies may lose competitive edges if tariff authority is overturned.

- Export‑oriented nations like India face revenue volatility that can rip through corporate earnings and sectoral valuations.

- Global importers and consumers could see lower prices and reduced supply chain costs.

- The U.S. budget could experience a sudden shortfall if tariff revenue disappears, affecting deficit projections.

It’s not just theory; markets are already pricing in uncertainty. Traders in prediction markets have heavily favoured a court ruling against broad tariff authority, signalling investor expectations of potential reversal.

Also Read: Emerging Markets Had A Great Year — What’s Next In 2026

What Trump Tariffs Mean for India and Global Trade

As someone tracking emerging market flows closely, I can tell you: this isn’t just door‑knocking political drama, it’s real money. India’s export landscape was reshaped dramatically in 2025 when the U.S. escalated duties to 50% on many goods. Over several months:

- Labour‑intensive sectors like textiles, gems & jewellery, seafood, and chemicals saw shipment values fall sharply, often more than 30% in key months.

- Some research estimated that as much as $48–$65 billion worth of Indian exports could be impacted if high tariffs persisted, a significant percentage of total U.S.‑bound trade.

- Key categories such as electronics (~$10–$11 billion) and gems & jewellery (~$9–$10 billion) were heavily exposed to tariff shifts that widened from single digits into the 50% range.

For India’s GDP and trade balance, the stakes were clear: exports to the U.S. accounted for roughly 20% of total merchandise exports in FY2025, and a tariff‑driven slump threatened near‑term growth forecasts. Here’s the dynamic I’m watching now:

- If tariffs are struck down or rolled back significantly, Indian exports could rebound quickly, a boon for exporters, currencies, and earnings.

- If tariffs are upheld in full force, vulnerable sectors may lose market share to competitors (e.g., Bangladesh or Vietnam), and export‑centric industries could see sharp margin compression.

The Broader Legal Implication: Major Questions Doctrine

One reason this case is so influential and why markets care is its reliance on the major questions doctrine. This legal principle holds that when a government policy has vast economic or political implications, Congress must clearly authorise it.

In trade contexts, this doctrine has already shaped other high‑profile Supreme Court decisions limiting broad executive reach from environmental regulation to student loans. In the tariff case, several justices have signalled unease about giving the executive branch what amounts to unbounded economic power through emergency authority.

If the court invokes this doctrine to curtail tariff authority, it could fundamentally recalibrate how future presidents influence trade policy a shift with ripple effects far beyond this single case.

So What Am I Watching Now?

As of today:

- No final ruling has been issued by the Supreme Court. The bench has already delayed its decision multiple times, a sign of the complexity and weight of the matter.

- Political moves in Washington, including efforts to preserve tariff authority through legislation demonstrate how high the stakes are on both sides.

- Trade negotiations continue globally, with partner countries pushing for tariff relief or alternative market access, reshaping export trajectories in real time.

Each of these developments underscores the unprecedented intersection of law, markets, and geopolitics in play.

Final Thoughts

I’ve read countless articles, sifted through data sets, and watched markets react in real time. But as someone deeply attuned to how policy decisions ripple from Washington to Mumbai to every global supply chain, what stands out most is this: The ruling isn’t just about Trump tariffs; it’s about who decides economic policy in the U.S.

If the Supreme Court holds back presidential authority here, it could strengthen legislative supremacy over economic policy and serve as a check on executive overreach. If it sides with the administration on those broad powers, the ruling could open the door to more aggressive unilateral action not only in trade but also in sanctions, investment restrictions and beyond.

For investors, that means monitoring policy risk at least as closely they do market data. For exporters and corporate boards, it also means advanced scenario planning, with legal developments sketched out on profit-and-loss statements and balance sheets.

Also Read: World Bank Raises Growth Outlook, Warns of Weakest Decade

Disclaimer

This article is for informational purposes only. It is not financial, legal, or investment advice. The views expressed reflect current developments and personal interpretation, and they may change as new information emerges. Readers should conduct their own research or consult a professional before making decisions based on this content.