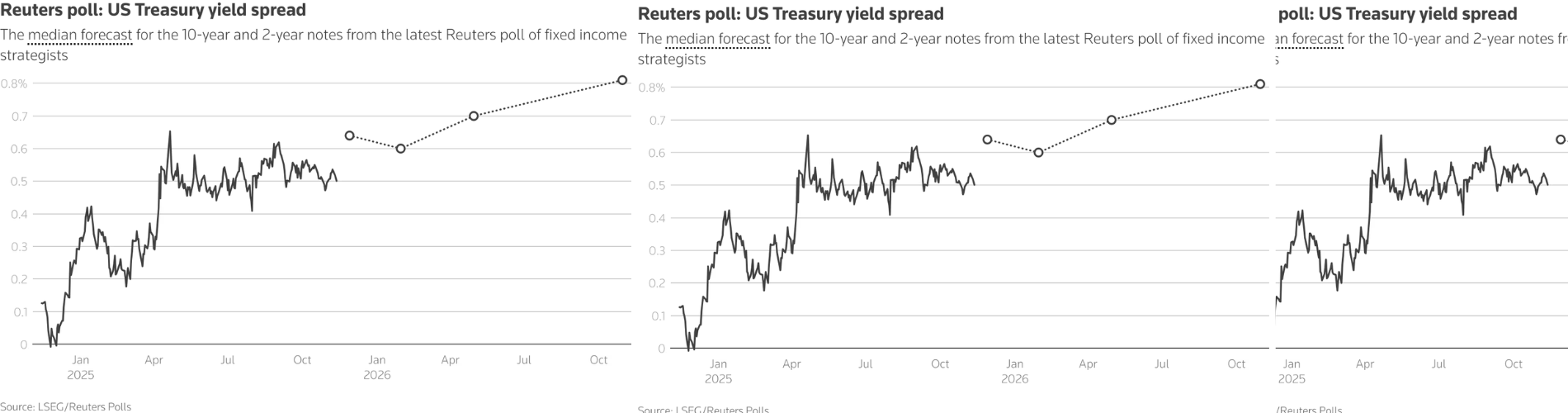

10-Year Treasury Yield Falls Ahead Of Key 2025 Data

U.S. Treasury yields edged slightly lower on Wednesday as investors stayed cautious ahead of the final economic data release of 2025.

The 10-year Treasury yield fell by 1 basis point to 4.11%, while the 2-year Treasury yield also dropped slightly to around 3.45%. Bond yields move in the opposite direction to prices, and one basis point equals 0.01%.

Short-term Treasury yields showed mixed movement, with 1-month and 1-year yields rising, while 2-year and 30-year yields dipped.

Investors are now focused on weekly jobless claims data, scheduled to be released later in the day. This will be the last major economic report of the year, and markets are watching closely for signals about the Federal Reserve’s next interest rate move.

On Tuesday, the Fed released minutes from its December meeting, showing that policymakers were divided over the decision to cut interest rates. The vote to lower rates was a close one, suggesting uncertainty about future policy steps.

After the minutes were released, U.S. stock markets traded slightly lower, while traders increased expectations that the Fed may cut rates again in April.