Adani Enterprises will fully exit its 44% stake in Adani Wilmar through a $2 billion multi-phase deal to focus on infrastructure. The first phase involves selling up to 31.06% to Wilmar International’s subsidiary, Lence Pte Ltd, via a call/put option. An additional 13% will be divested to meet public shareholding norms. Adani Wilmar will rebrand […]

Budget 2025: Investment in country roads could boost the economy.

As preparations for Budget 2025 gain momentum, Finance Minister Nirmala Sitharaman and her team are set to introduce measures aimed at boosting India’s economic resilience and promoting inclusive growth. A major focus area is expected to be rural infrastructure, particularly roads. The government is likely to increase the allocation for rural road development by about […]

Hinduja Group firm plans to acquire RCAP by January and grow its financial services business to $50 billion in five years.

Hinduja Group’s IndusInd International Holdings Ltd (IIHL) expects to finalize its acquisition of debt-laden Reliance Capital (RCAP) by the end of January 2024. IIHL, which won the bid for Rs 9,650 crore, aims to triple its banking, financial services, and insurance (BFSI) business to $50 billion by 2030. The company has also committed an additional […]

7 midcap stocks hit 52-week highs, gaining up to 20% in a month.

On Tuesday, Sensex closed flat at 81,510, with a 1-point gain. Seven BSE midcap stocks reached 52-week highs, reflecting strong performance over the past month: These highs showcase investor confidence and potential growth opportunities.

PAN 2.0: CBDT announces free e-PAN updates; details here.

The central government has launched PAN 2.0, an upgraded version of the Permanent Account Number (PAN) system, aimed at enhancing taxpayer services in India. This e-governance initiative seeks to modernize the taxpayer registration process through technology. PAN 2.0 will completely replace the existing PAN/TAN 1.0 system, streamlining essential and additional PAN/TAN functions, including PAN validation […]

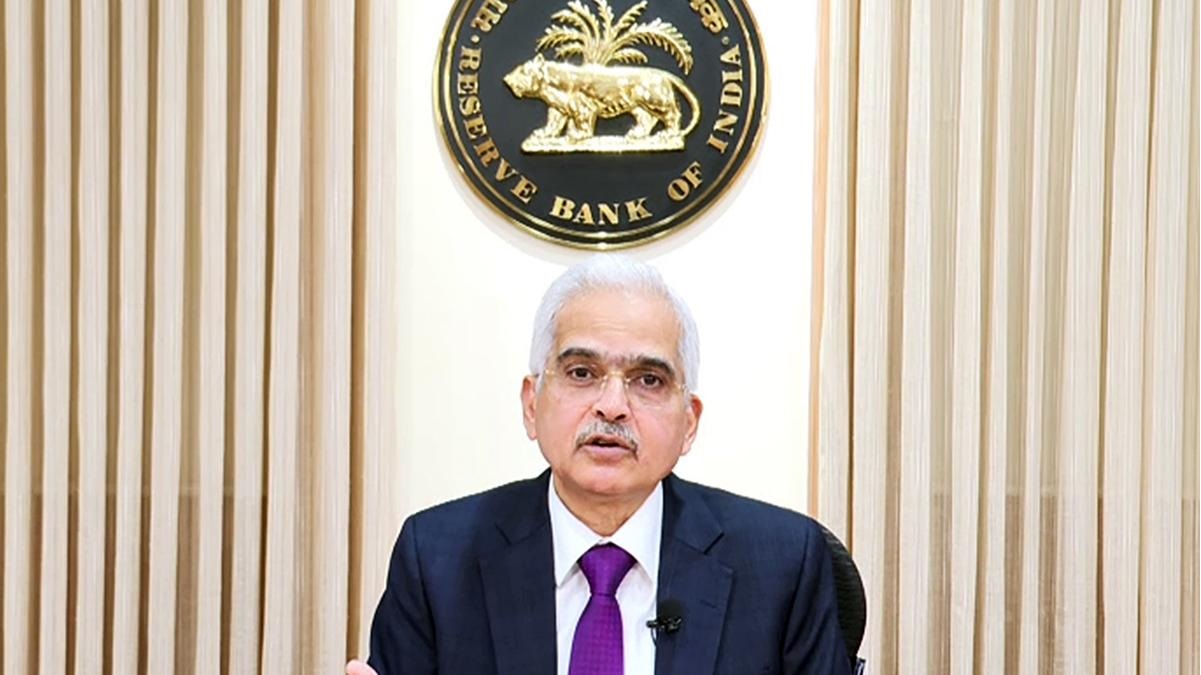

RBI MPC keeps repo rate at 6.5%, revises GDP and inflation forecasts.

The Reserve Bank of India’s (RBI) Monetary Policy Committee (MPC) decided to keep the repo rate unchanged at 6.5% for the 11th consecutive meeting, with a 4:2 vote, citing concerns over inflation and uncertain growth. The RBI maintained its ‘neutral’ stance, moving away from the previous ‘withdrawal of accommodation’ stance. RBI Governor Shaktikanta Das noted […]

Ramesh Damani to meet MSTC management on Dec 9; shares rise 6%.

Shares of state-run MSTC rose by 6% to Rs 771.30 on Thursday after the company announced a one-on-one meeting with investor Ramesh Damani scheduled for Monday, December 9. MSTC, where the government holds a 64.75% stake, provides e-commerce services across various sectors. In its filing to the stock exchanges, MSTC confirmed the meeting with Damani […]

Jewellery stocks soar: 9 rise over 50%, 4 become multibaggers in 6 months.

Golden Gains in Jewellery Stocks Over the past six months, jewellery stocks have seen significant price surges. Nine jewellery stocks, each with a market cap of over Rs 1,000 crore, have risen by over 50%, with four becoming multibaggers, offering investors substantial returns. Titan Company, while experiencing a steady growth trend, has shown relatively flat […]

Cement shares jump 5% as ICICI Securities upgrades UltraTech and four others.

ICICI Securities has upgraded its outlook on the cement sector from neutral to positive, citing improved market fundamentals. This change is driven by reduced competitive pressures following recent mergers and acquisitions, favorable pricing trends, and robust capacity expansions. The announcement sparked a rally in cement stocks, with shares of major manufacturers surging over 5% on […]