RBI MPC keeps repo rate at 6.5%, revises GDP and inflation forecasts.

The Reserve Bank of India’s (RBI) Monetary Policy Committee (MPC) decided to keep the repo rate unchanged at 6.5% for the 11th consecutive meeting, with a 4:2 vote, citing concerns over inflation and uncertain growth. The RBI maintained its ‘neutral’ stance, moving away from the previous ‘withdrawal of accommodation’ stance.

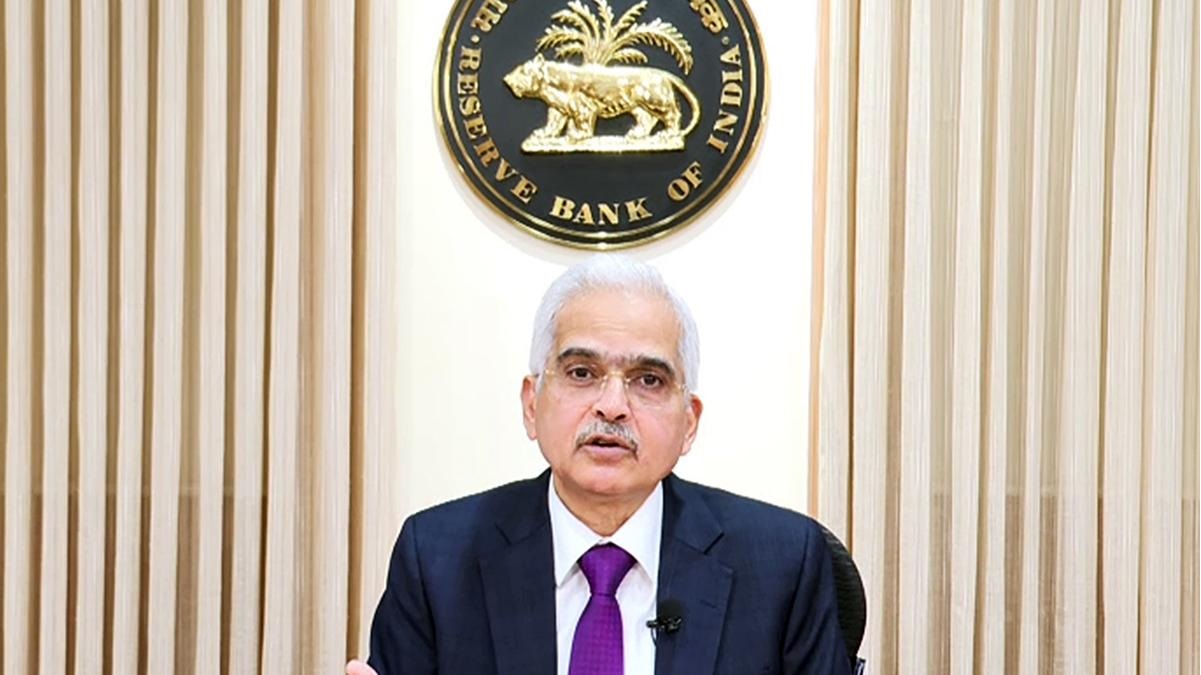

RBI Governor Shaktikanta Das noted that inflation remains high, particularly due to persistent food inflation, but expressed optimism about India’s growth, driven by good monsoon seasons and expected capital expenditure revival. However, the RBI revised its growth forecast downward, acknowledging a slowdown in momentum.

Despite pressure from the government and economists to ease borrowing costs, Governor Das ruled out immediate rate cuts, as inflation remains above the RBI’s 4% target.

The RBI revised its inflation forecast for the current fiscal year to 4.8%, with inflation projections for Q3 and Q4FY25 at 5.7% and 4.5%, respectively. For FY26, inflation is expected to be 4.6% in Q1 and 4% in Q2. On the growth front, the RBI lowered India’s GDP growth forecast for FY25 to 6.6%, down from 7.2%, and also revised the growth projections for Q3FY25 and Q4FY25.