Tata Motors Q3 FY26 Results: 48% Profit Drop and What It Means for Investors

When I saw Tata Motors’ stock fall over 4 per cent after its Q3 FY26 results, my first instinct wasn’t to react, but it was to read. In today’s market, quarterly earnings frequently trigger emotional responses, especially when profits fall sharply. But as an investor, I’ve learned that headline numbers rarely tell the full story; they can often mean more than they seem.

Table of Contents

ToggleThis article is my attempt to decode what actually went wrong, what stayed strong, and what truly matters going forward for Tata Motors. I’ll walk through the Q3 FY26 numbers, explain why profits declined despite revenue growth, analyse what brokerages are saying, and most importantly, share my personal take on whether this correction changes the long-term investment narrative.

If you’re trying to decide whether Tata Motors’ recent dip is a warning sign or a pause in a longer journey, this article is for you.

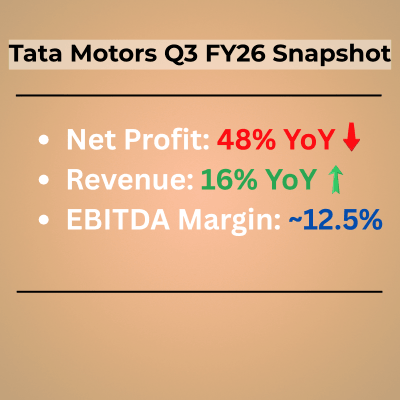

Tata Motors Q3 FY26: The Numbers That Shook the Market

Tata Motors reported a consolidated net profit of ₹705 crore for Q3 FY26, a steep 48 per cent decline year-on-year compared to ₹1,355 crore in Q3 FY25. Predictably, the market focused on this single number and punished the stock.

But I believe this reaction ignores a crucial detail: this was not a clean operational miss. The quarter was weighed down by exceptional, non-recurring expenses, which significantly made a mess the bottom line.

Exceptional Costs: The Real Reason Profits Took a Hit

Tata Motors incurred an exceptional charge of ₹1,643 crore during Q3FY26, including:

- ₹962 crore of stamp duty charges linked to the transfer of land under its demerger scheme

- ₹603 crore due to the implementation of new labour codes

- ₹82 crore for the cost of acquisition

These are nonrecurring, one-time adjustments that aren’t indicative of the company’s ongoing profitability. This distinction matters because markets often tend to punish stocks in the short run, but long-term investors benefit by separating noise from fundamentals.

Revenue Growth Tells a Different Story

While profit figures disappointed, revenue performance quietly impressed.

Tata Motors’ revenue from operations rose over 16 per cent YoY to ₹21,847 crore in Q3 FY26. This growth is indicative of the demand having remained firm, more so in its commercial vehicle (CV) stable; the CV business now forms the bedrock of Tata Motors’ listed entity.

What stood out even more to me was margin stability:

- Operating margin improved to 12.60%, up from last year 12.07%

- EBITDA margin rose by 30 basis points to ~12.5%

- Profit margin fell to 3.23%, primarily due to exceptional costs

At a time of rising commodity prices and input cost pressure, keeping margins steady is not a small achievement.

Brokerage Views: A Stock Caught Between Caution and Conviction

Motilal Oswal: Valuation Comfort, Execution Concerns

Motilal Oswal maintained a ‘Neutral’ stance on Tata Motors, citing input cost pressures and margins coming in lower than expected.

What I found more important was its concern around gradual market share loss in key CV segments and risks linked with Tata Motors’ Iveco acquisition, especially amid global macro uncertainty.

The brokerage estimates:

- 9% volume CAGR in domestic CV demand between FY25–FY28

- Margins stabilising around 13% over the same period

Despite these assumptions, Motilal Oswal believes the stock is fairly valued at current levels, assigning a target price of ₹431, implying an upside of just over 8 per cent.

Emkay Global: The CV Upcycle Is Far From Over

Emkay Global took a more optimistic stance, and this is where my thinking aligns more closely.

According to Emkay, Tata Motors’ net profit exceeded its internal estimates, mainly due to lower-than-expected tax expenses. More importantly, it believes thedemand for commercial vehicle environment remains structurally strong, with double-digit growth likely to continue until H1 FY27.

Emkay expects Tata Motors to lead this multi-year CV upcycle, retaining its ‘Buy’ rating with a target price of ₹650, implying over 38 per cent upside from recent levels.

JM Financial: Near-Term Pressure, Long-Term Levers

JM Financial provided a balanced view, warning that rising commodity prices could pressure margins in Q4 FY26.

However, it also highlighted Tata Motors’ countermeasures:

- A 1 per cent price hike effective on January 1, 2026

- Scope for reduced discounting

- Operating leverage benefits

JM Financial retained a ‘Buy’ call with a target price of ₹550, indicating almost 17 per cent upside.

My Personal Take: Is This a Red Flag or a Reality Check?

Following the numbers and commentary, here’s how I see Tata Motors’ Q3 FY26 results:

- The profit decline is optical, a result of one-time costs

- Revenue growth and margin stability are indicators of operational strength

- The CV demand cycle remains intact, though there are competitive pressures.

- Valuations now demand consistent execution, not just optimism

This quarter, to me, feels like a reality check, not a breakdown.

What I’ll Be Watching Before Increasing Conviction

Going forward, these are the factors that will influence my outlook:

- Shifting market share across CV segments

- Sustainability of EBITDA margins of over 12.5%

- Commodity price trends vs pricing power

- Acquisitions execution and integration risks

- Domestic infrastructure-led CV demand visibility

If Tata Motors executes these right, then this recent correction could eventually look like a consolidation phase rather than a reversal of trend.

Conclusion: A Quarter That Tests Patience, Not the Business

Tata Motors’ Q3 FY26 results were far from perfect, but they weren’t broken either. The sharp decline in net profit masks a business that continues to grow revenues, protect margins, and operate within a supportive long-term demand cycle.

For investors like me, this is not a quarter that changes the story; it’s a quarter that tests conviction.

Also Read: L&T Shares Rise 4% After Q3 FY26 Results: What the Market Is Focusing On

Disclaimer

This article is for informational purposes only and reflects personal analysis and opinions. It should not be considered investment advice. Investors should conduct their own research or consult a qualified financial advisor before making investment decisions. Stock market investments are subject to market risks.