US 10-Year Yield Slips After Strong GDP Data

U.S. Treasury yields moved a little lower on Wednesday as investors got ready for a shortened trading day before the Christmas holiday.

The 10-year Treasury yield, which is an important benchmark for U.S. borrowing costs, slipped slightly to 4.159%.

The 2-year Treasury yield stayed almost the same at 3.528%.

The 30-year Treasury yield also showed very little change and stood near 4.824%.

Bond yields move opposite to prices, and even a small change is measured in basis points. One basis point equals 0.01%.

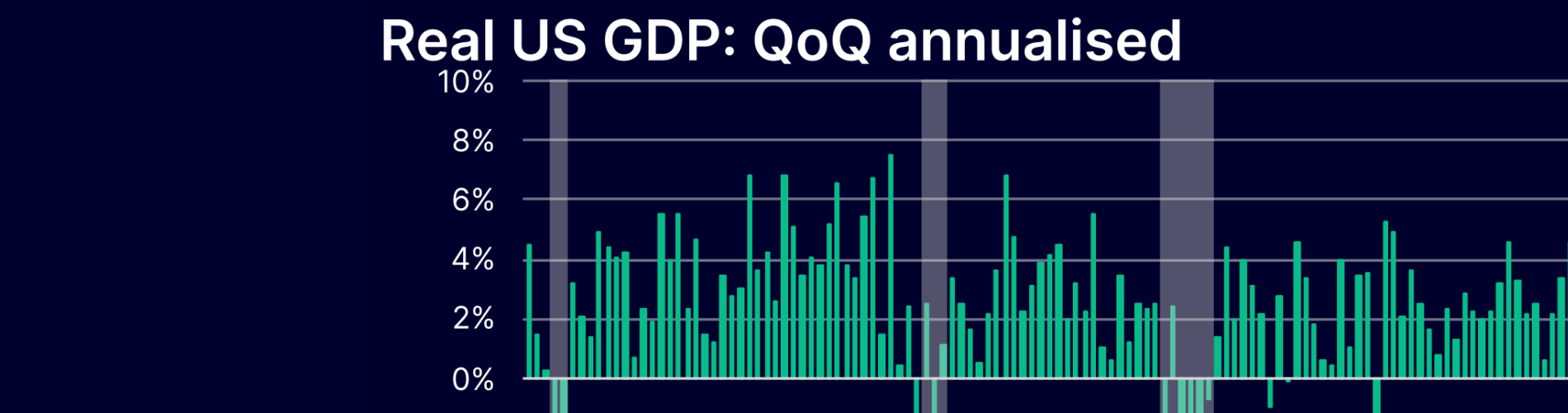

Investors were also reacting to new data showing that the U.S. economy grew by 4.3% in the third quarter, the fastest growth seen in the past two years. Strong economic growth can make it harder for the Federal Reserve to decide when to cut interest rates.

Kevin Hassett, a senior economic official, said the Fed is not cutting rates fast enough compared to other countries. However, Cleveland Fed President Beth Hammack believes rates should stay where they are for a few more months because inflation is still a concern.

According to market expectations, most investors now think the Fed will keep interest rates unchanged until April, before starting rate cuts again.

Bond markets will close early on Wednesday at 2:00 p.m. and will remain closed on Thursday for Christmas Day.