Emerging Markets Had A Great Year — What’s Next In 2026

Emerging markets are becoming one of the most attractive investment options as 2026 approaches. After being ignored for many years, investors on Wall Street are once again showing strong interest. Many fund managers believe emerging markets could see steady money inflows for a long time, not just a short-term rise.

This year has already shown strong signs of this change. Money flowing into emerging-market stocks, bonds, and currencies is at its highest level since 2009. This makes it the best year for emerging-market inflows in more than a decade. Investors now feel that these markets may be entering a long recovery phase, instead of just a temporary bounce.

For many years, emerging markets struggled to attract investors. Slow economic growth, political problems, and the strong performance of US tech stocks kept most money invested in developed markets like the US. Many investors reduced or completely stopped investing in emerging markets because returns were weak and risks were high.

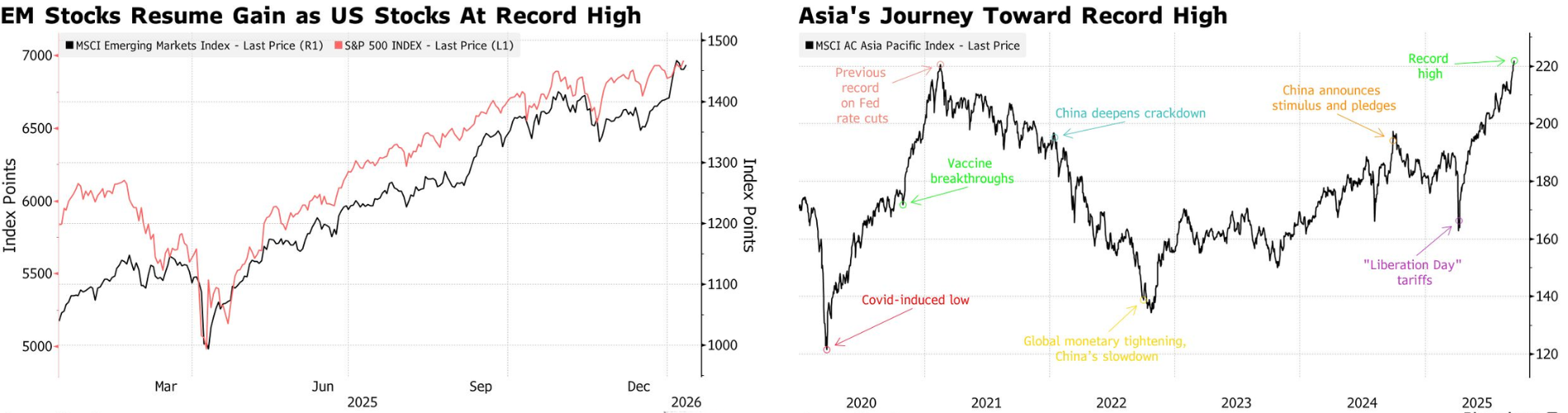

Now, that mood is changing. One major sign is in the stock market. Emerging-market stocks are beating US stocks for the first time since 2017. This is important because US markets have dominated global investing for years. The shift shows investors are now looking beyond the US for better future returns.

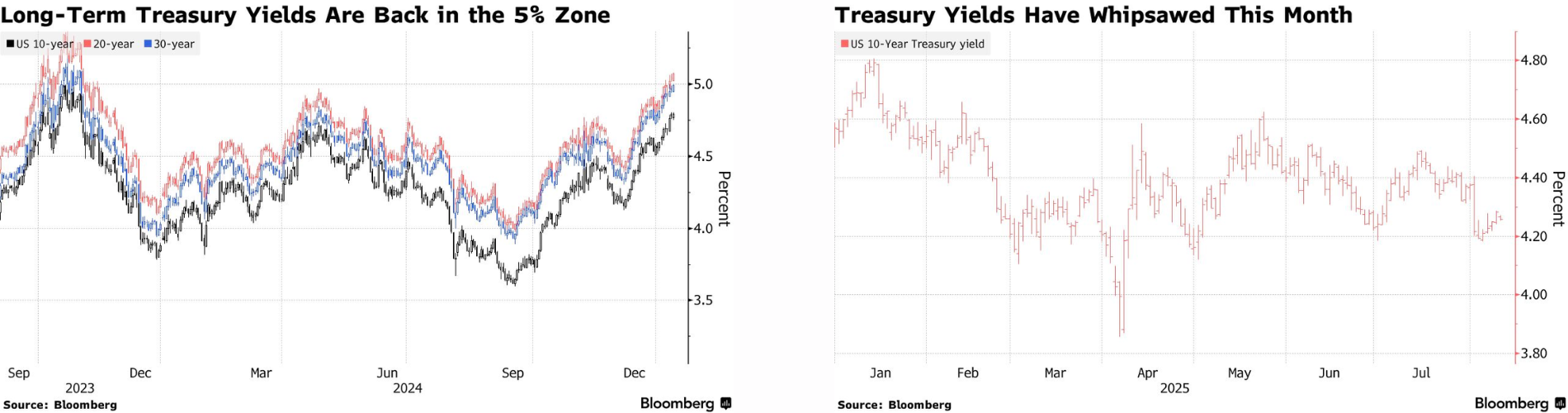

Bond markets are also supporting this trend. The difference between emerging-market bond yields and US Treasury yields is now the smallest it has been in 11 years. This suggests investors see emerging-market bonds as less risky than before, especially as US interest rates stabilize and inflation slows down.

Currency markets tell a similar story. Carry trade strategies, where investors borrow in low-interest currencies and invest in higher-yielding emerging-market assets, have delivered their best returns since 2009. This shows investors are more comfortable taking risks and have growing confidence in emerging economies.

Strong economic fundamentals are also helping emerging markets. Many countries have lower debt, healthier finances, and central banks that acted early to control inflation. Because of this, they now have more room to cut interest rates or support growth if needed.

At the same time, valuations in emerging markets are still cheaper compared to developed markets, especially the US. After years of weak performance, stock prices remain reasonable, making them attractive for long-term investors if company earnings continue to improve.

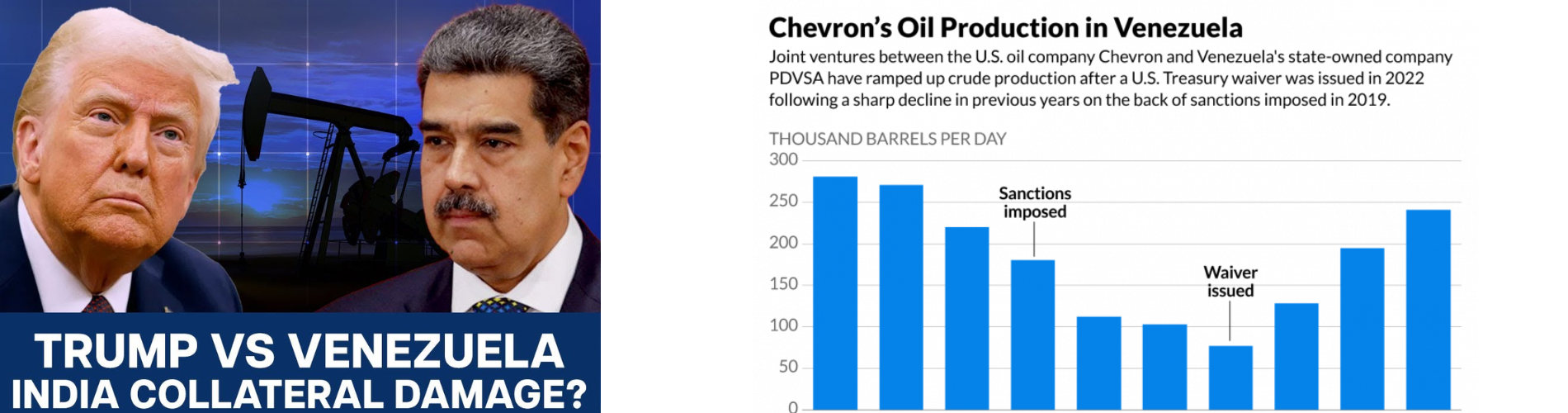

However, investors are being careful. Instead of investing in all emerging markets together, they are choosing specific countries and sectors. Markets with strong local demand, better governance, and links to global manufacturing shifts are getting more attention, while countries with political or financial issues are still being avoided.

As 2026 gets closer, many investors believe emerging markets are finally making a comeback. Strong inflows, better performance, and improving confidence suggest this trend could last. While risks like global politics and economic slowdowns remain, investors increasingly see emerging markets as a place for long-term growth, not just a short-term opportunity.