Venezuela Stocks Jump 130% After Maduro Ouster

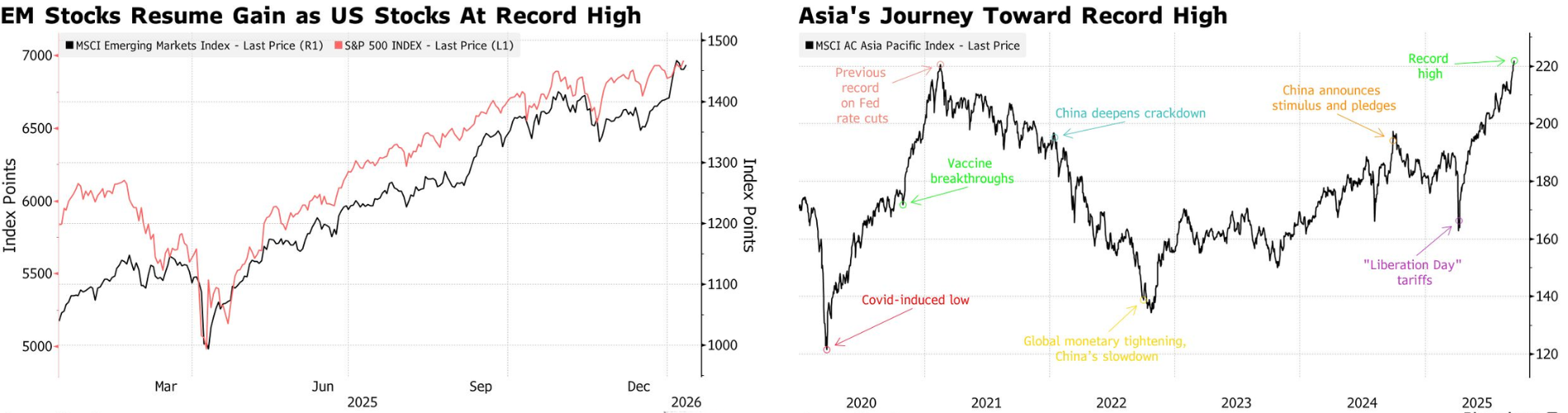

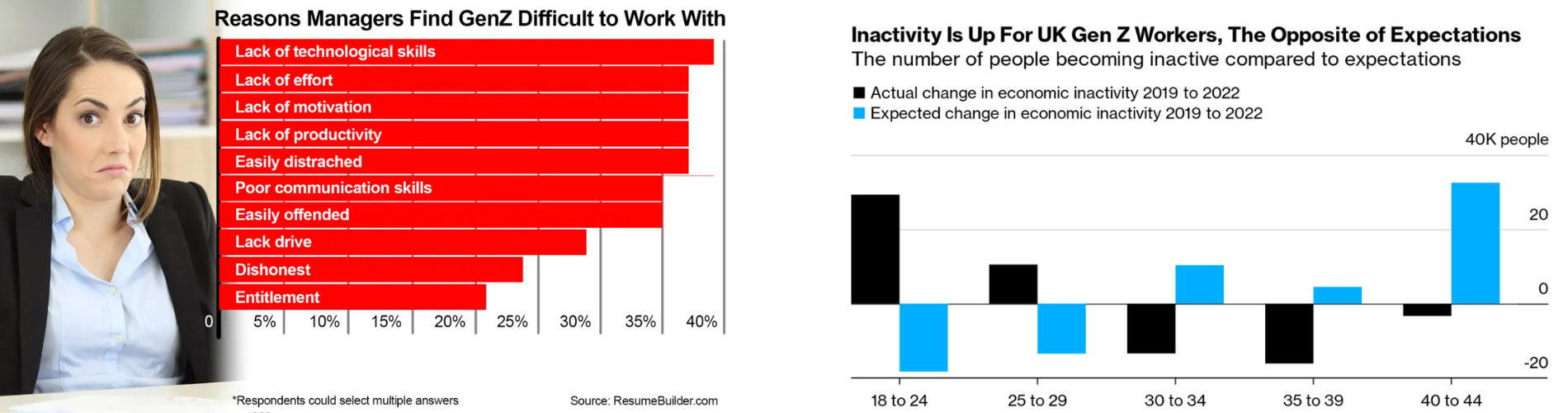

Venezuela’s stock market has surged dramatically following the capture of former President Nicolás Maduro by U.S. forces, sparking hopes of an economic turnaround. The country’s main stock index, the Indice Bursatil de Capitalizacion (IBC), has jumped more than 130% since the political change in early January 2026, reaching record highs.

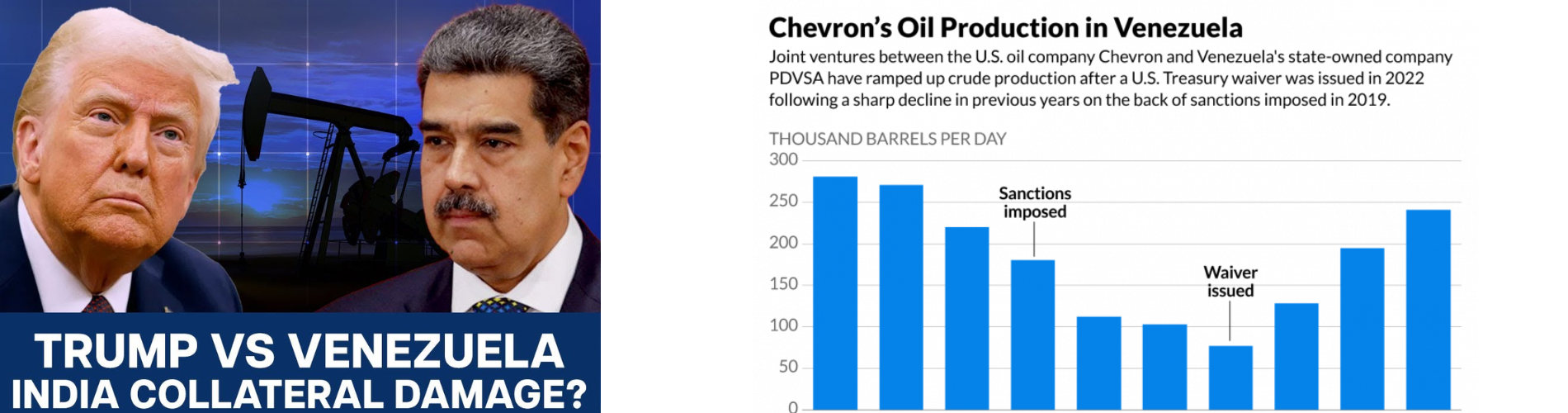

Investors are optimistic that the move could stabilize Venezuela’s battered economy after years of mismanagement, sanctions, and defaults. Many believe a new government could attract foreign investment, revive oil production, and normalize relations with the United States, which would boost confidence in the market.

The rally has caught the attention of international investors. U.S.-based ETF issuer Teucrium has applied to create what could be the first exchange-traded fund focused on Venezuelan companies. Analysts say the surge reflects both hope and speculation, as Venezuela’s stock market is small, thinly traded, and volatile. Even small changes in expectations can lead to large price swings.

Interest is also growing in Venezuela’s sovereign and state oil company bonds, driven by optimism that potential debt restructuring could unlock long-frozen value since the 2017 default. Despite the excitement, experts caution that much of the rally is headline-driven and tactical. A political change alone does not guarantee a full economic recovery.

Venezuela still faces major challenges. External debts and arbitration claims are estimated at $150–170 billion, which could complicate any economic turnaround. Analysts note that while the current rally shows investor optimism, structural reforms and long-term stability are needed to sustain growth.

In summary, Venezuela’s markets are experiencing a historic surge amid political change, offering opportunities for investors but also carrying high risks due to volatility and ongoing economic uncertainty.