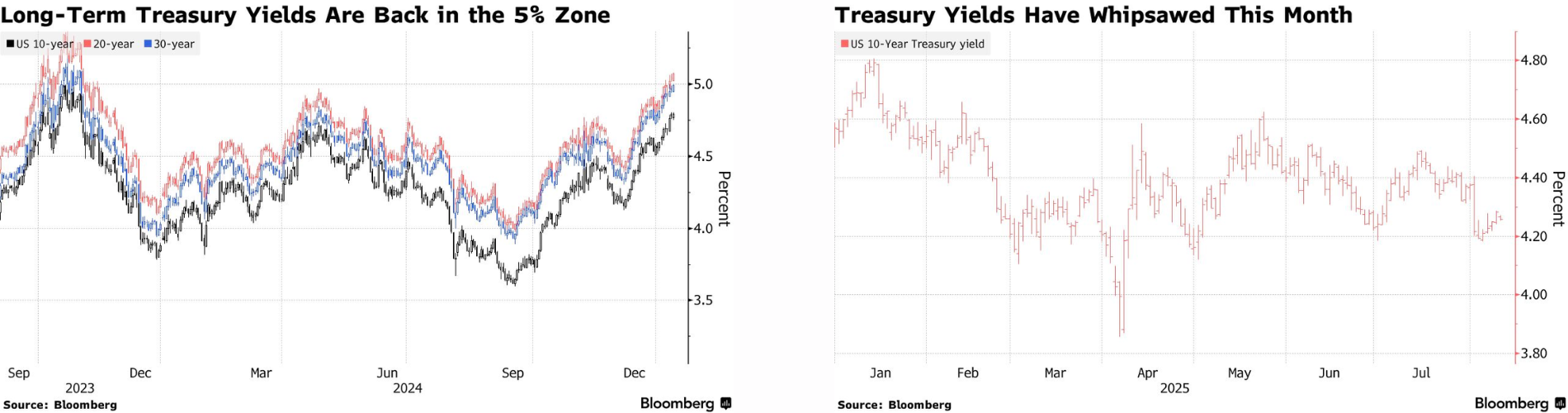

Treasury Yields Rise Ahead of Key Inflation Data

U.S. Treasury yields edged up on Tuesday, with investors hungry for significant inflation data in an effort to determine how the U.S. economy might fare.

The yield on the 10-year Treasury note increased less than a basis point, to 4.197%. The 30-year Treasury bond yield rose slightly to 4.85%. A basis point is equivalent to 0.01 percent, and bond prices generally rise when yields fall.

Investors eagerly await the consumer price index (CPI) report that is expected to reveal the behavior of inflation after being distorted by last year’s long U.S. government shutdown. Economists anticipate inflation will be 2.7% higher over the past year, matching November’s level.

On the heels of a report from January’s jobs market, which found that the labor push is slowing but still strong, bond markets are watching inflation. For that reason, many expect the Federal Reserve to wait longer before cutting interest rates.

Investors expect the Fed to cut interest rates twice this year, in two small moves that could begin as early as June, futures market data show.

Contributing to market swirl was the Fed Chair Jerome Powell’s disclosure that the Justice Department has opened a criminal probe related to a $2.5 billion renovation of the Fed’s headquarters in Washington. The investigation could have implications for the central bank’s course of action going forward, Powell said.