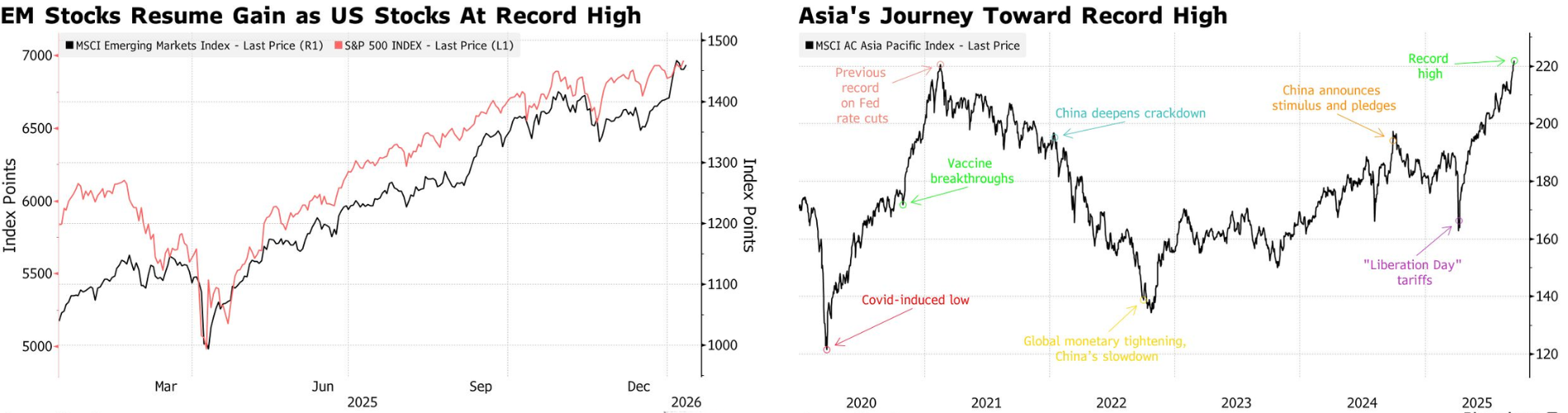

Asia-Pacific Stocks Up After US Markets Hit New Highs

Asia-Pacific markets rose on Monday, following strong gains on Wall Street last week. Investor confidence improved after a U.S. jobs report showed that the unemployment rate had fallen, signaling that the American labor market remains strong.

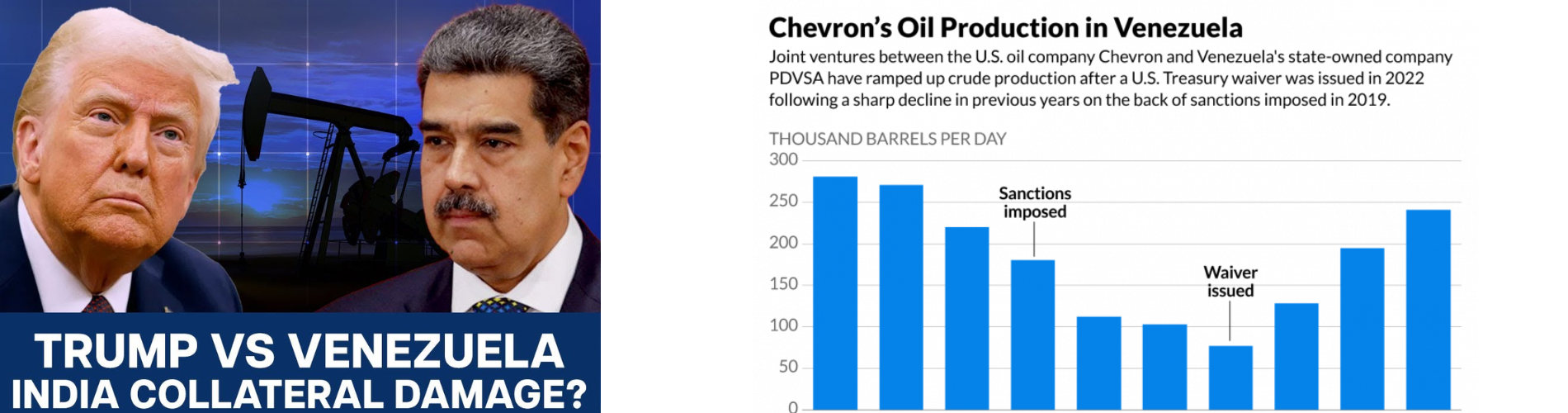

Investors are also closely watching oil prices, as protests in Iran have entered their third week. According to a U.S.-based human rights group, more than 500 people have been killed so far. Reports say U.S. President Donald Trump is considering possible intervention, adding to global market uncertainty.

Oil and Gold Update

-

Brent crude prices fell to $63.05 per barrel

-

U.S. crude (WTI) slipped to $58.83 per barrel

-

Gold prices jumped over 1.6%, hitting a record high of $4,581 per ounce, as investors looked for safe-haven assets

Market Performance Across Asia

-

Australia’s ASX 200 rose 0.38%

-

South Korea’s Kospi climbed 1.11%, while the Kosdaq gained 0.96%

Shares of Hyundai Glovis jumped as much as 8% after analysts raised their price target. The move came after Boston Dynamics, partly owned by Hyundai Glovis, announced an AI partnership with Google DeepMind. -

Hong Kong’s Hang Seng Index and China’s CSI 300 opened slightly lower

-

Japanese markets were closed for a public holiday

Meanwhile, the Japanese yen weakened sharply, falling to a one-year low against the U.S. dollar.

U.S. Markets Recap

U.S. stock futures were flat during early Asian trading hours, ahead of a busy week filled with key economic data and company earnings.

On Friday:

-

The S&P 500 rose 0.65% to a record close

-

The Nasdaq Composite gained 0.81%

-

The Dow Jones added nearly 238 points, also ending at a new all-time high

Overall, global markets are balancing optimism from strong U.S. data with concerns around geopolitics and commodity prices.