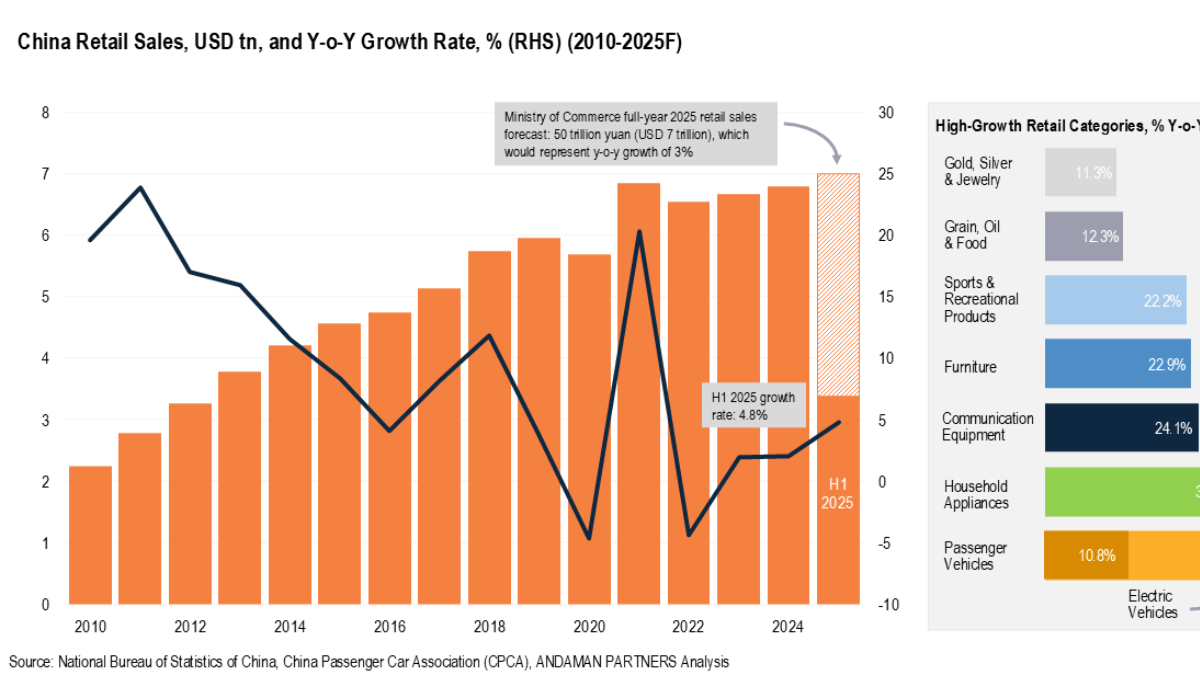

China Retail Sales Miss Estimates In November.

China’s economy slowed down further in November, with consumption, investment, and industrial production all growing less than expected. Authorities are trying to control supply but are struggling to boost demand and support the weak property sector.

Retail sales rose only 1.3% compared to last year, much lower than the expected 2.8% and slower than October’s 2.9% growth. Industrial production grew 4.8%, missing the forecast of 5% and marking the weakest growth since August 2024.

Investment in fixed assets, including property, fell 2.6% for January to November, worse than the expected 2.3% drop and the sharpest decline since the 2020 pandemic. Real estate investment dropped 15.9% in the first 11 months, and home prices in major cities continued to fall, with new homes down 1.2% and resale homes down 5.8%.

Auto sales also hurt retail numbers. In November, car sales dropped 8.1%, the first decline in three years, as trade-in subsidies were paused by local governments. Even long-running online shopping promotions, like the extended Singles’ Day sales, didn’t boost spending enough.

Policymakers plan to support the economy next year through government bonds and investment programs aimed at boosting domestic consumption and upgrading equipment. However, experts say stronger measures are needed, including better job prospects, wage growth, and structural reforms to support households and private businesses.

China’s urban unemployment rate was 5.1%, with youth unemployment high at 17.3%. Despite domestic challenges, exports are strong, helping the country stay on track for its 5% growth target. China’s trade surplus hit a record $1.1 trillion in November, raising concerns about its reliance on foreign demand.

Economists urge China to focus more on domestic consumption rather than relying heavily on exports. The yuan has strengthened recently, which could affect trade competitiveness.