Europe’s Banks: Stellar 2025, Big Question For 2026

2025 was an unusual year for global markets, breaking the usual patterns after an election year. If 2024 was just the warm-up, 2025 was the main event.

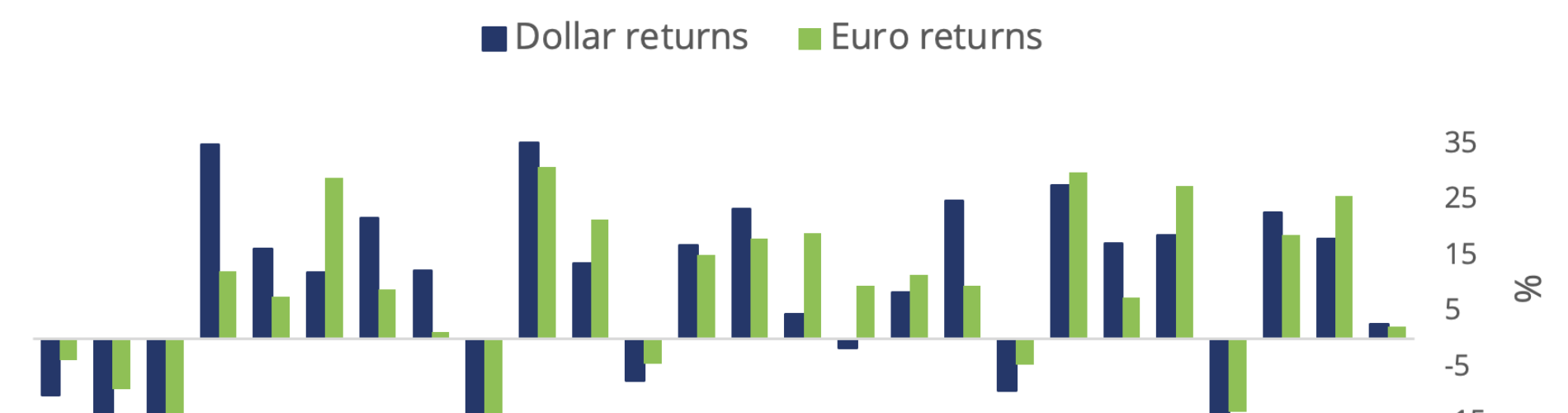

The year was shaped by America First policies, which pushed the world to rely less on the US Dollar. While the US signed new trade deals, the global economic landscape is clearly shifting.

Geopolitical tensions continued. Conflicts in the Middle East and Ukraine didn’t end—they just changed form. Summits like the Trump-Xi meeting in Busan provided temporary peace, but underlying issues stayed unresolved.

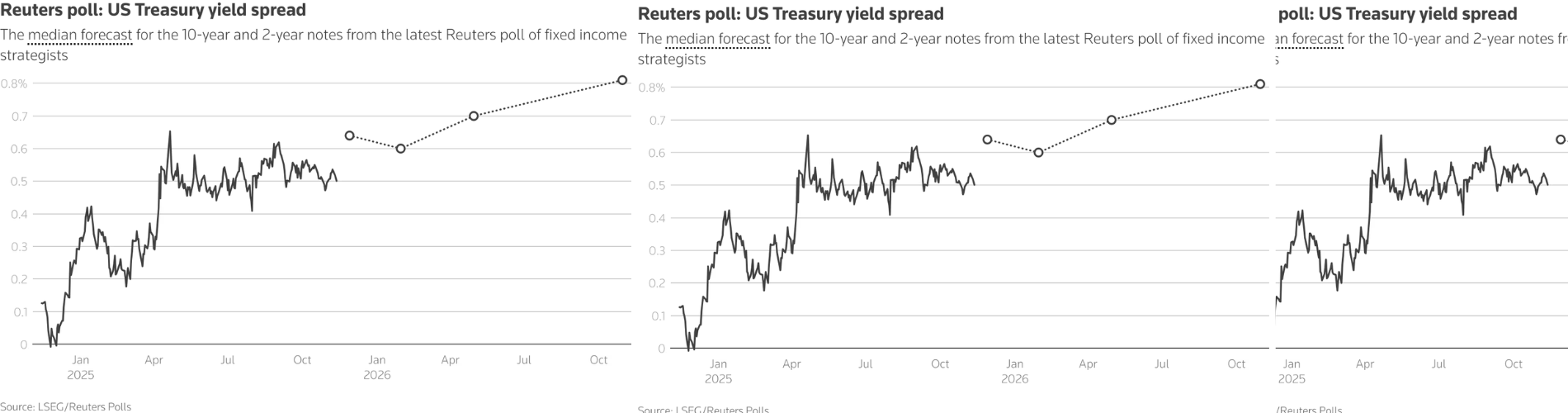

Central banks in developed countries kept cutting interest rates, giving markets extra cash and keeping stocks strong despite political uncertainties.

In Japan, the “Takaichi Yen-run” was a major event. The yen dropped 11% against the US Dollar in the first half of the year, then recovered slightly, creating big swings for other currencies like the Euro and Japanese Yen (EUR/JPY).

Overall, traders had to navigate a year of high volatility, changing policies, and major currency movements—making 2025 a year to remember in global markets.