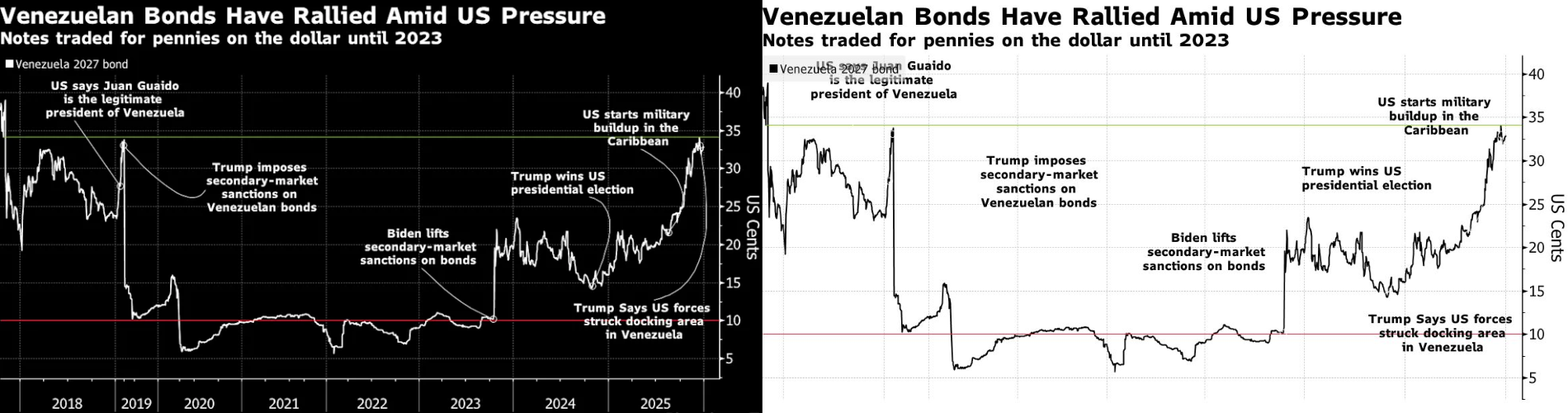

Venezuela Bond Bet Pays Off With 30% Gain

A London-based hedge fund, Altana Wealth, has started 2026 with strong performance by making a smart bet on Venezuela’s debt. Its Altana Credit Opportunities Fund saw an estimated 30% gain in the first trading days of the year after Venezuelan bonds jumped in price. This rise came after the U.S. arrest of President Nicolás Maduro, which sparked optimism among investors about Venezuela’s future.

The fund focuses on Venezuela’s government bonds and PDVSA oil company debt, which had been trading at very low prices for years. Investors bought these debts when they were deeply discounted, hoping they would eventually recover. The strong gain in early 2026 follows an estimated 66% return in 2025, showing how much the strategy has paid off.

Altana’s manager, Lee Robinson, first launched the fund more than five years ago, predicting that Venezuelan bonds could climb dramatically if the political situation changed. Now, with prices rising, his bet looks wise. The fund currently manages around $150 million and has drawn extra attention from global investors watching Venezuela’s debt rally.

Other hedge funds and money managers are also benefiting as Venezuelan debt gains value. Some believe there’s more room for upside if the country moves toward normalising its economy and restructures its debt. With Venezuela holding some of the world’s largest oil reserves, creditors are watching closely, hoping political change could unlock even higher recovery values for bonds and related instruments