World Bank Raises Growth Outlook, Warns of Weakest Decade

The World Bank has slightly upgraded its global growth outlook, citing stronger-than-expected performance in advanced economies. However, it has also issued a stark warning: the world is heading toward its weakest decade of economic growth since the 1960s.

In its latest Global Economic Prospects report, the World Bank described a global economy that is proving resilient in the face of uncertainty but remains too slow and uneven to significantly reduce poverty or improve long-term living standards, especially in emerging markets.

The report highlights a growing divide between short-term resilience and long-term dynamism, raising concerns about stagnation, job creation, and financial vulnerability across developing economies.

World Bank Upgrades Global Growth Forecast for 2025–2027

According to the World Bank, global GDP growth is now expected to:

- Grow 2.7% in 2025

- Slow slightly to 2.6% in 2026

- Edge back up to 2.7% in 2027

While the overall growth path remains subdued, the Bank upgraded its forecasts compared to its June outlook:

- 2025 growth revised up by 0.4 percentage points

- 2026 growth revised up by 0.2 percentage points

The upward revision reflects greater resilience in advanced economies, particularly the United States, despite ongoing trade disruptions and geopolitical tensions.

United States Drives Majority of the Upward Revision

Nearly two-thirds of the improved global outlook comes from stronger-than-expected economic performance in the United States.

The World Bank now forecasts:

- U.S. growth of 2.1% in 2025

- U.S. growth rising to 2.2% in 2026

Both figures were revised higher from the Bank’s June estimates.

Tariffs and Tax Incentives Shape U.S. Outlook

The report notes that U.S. growth in 2025 was partially weighed down by an early surge in imports, as businesses rushed to front-run anticipated tariffs. This import front-loading reduced net exports and slowed growth in the short term.

However, the Bank expects larger tax incentives to support economic activity in 2026. These incentives are likely to:

- Encourage business investment

- Support consumer spending

- Offset some of the negative effects of tariffs on trade and consumption

As a result, the U.S. economy remains one of the few strong growth engines globally.

“Low-Growth, High-Resilience” Becomes the New Global Reality

Despite the improved near-term outlook, the World Bank emphasized that the global economy has entered a “low-growth, high-resilience” phase.

This means economies are:

- Absorbing shocks better than expected

- Remaining stable despite policy uncertainty

- But failing to generate strong, broad-based growth

According to the World Bank’s chief economist, this growing gap between resilience and growth cannot persist indefinitely.

“With each passing year, the global economy has become less capable of generating growth and seemingly more resilient to policy uncertainty,” he warned.

Over time, this imbalance could strain public finances, weaken credit markets, and limit governments’ ability to respond to future shocks.

Weakest Decade of Global Growth Since the 1960s

Perhaps the most concerning message from the report is its long-term outlook.

The World Bank estimates that the 2020s are on track to become the slowest decade for global growth since the 1960s. This pace is insufficient to prevent:

- Long-term economic stagnation

- Rising joblessness

- Increased financial vulnerability

- Slower poverty reduction

This is particularly troubling for emerging markets and developing economies, which rely on faster growth to improve living standards and close income gaps with advanced nations.

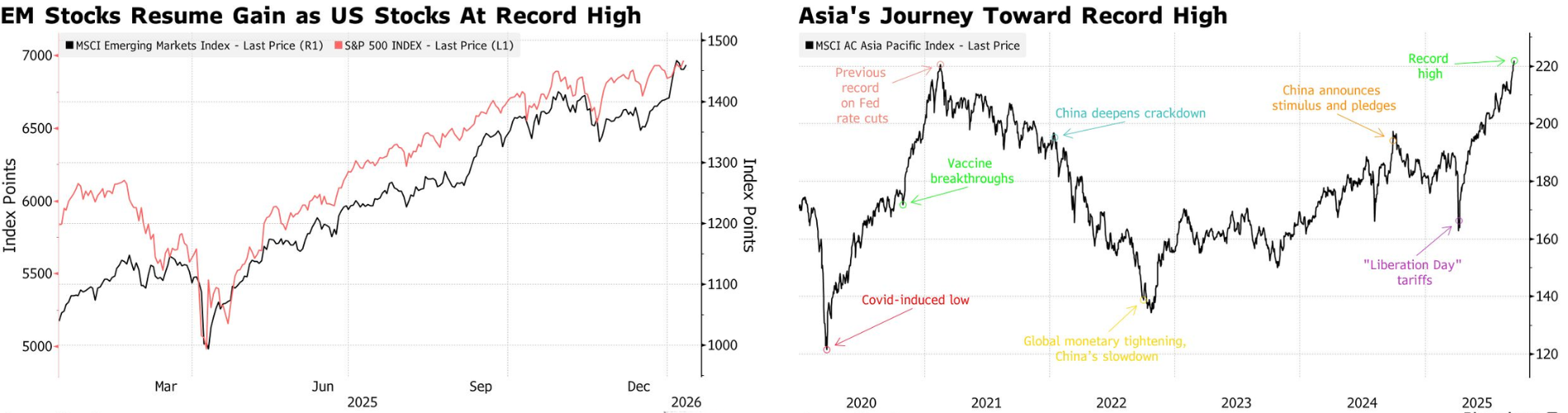

Emerging Markets Face Slowing and Uneven Growth

Growth in emerging market and developing economies (EMDEs) is expected to:

- Slow to 4.2% in 2025

- Further ease to 4.0% in 2026

Although these forecasts were revised slightly higher, they still represent a gradual deceleration.

Excluding China, Growth Remains Stagnant

When China is excluded, growth in emerging and developing economies is forecast to stagnate at 3.7% in 2026, unchanged from 2025.

This stagnation highlights a deeper issue: many emerging economies are struggling with:

- Weak investment

- High debt burdens

- Limited fiscal space

- Structural inefficiencies

Without significant reforms, the World Bank warns these economies may find it increasingly difficult to sustain growth.

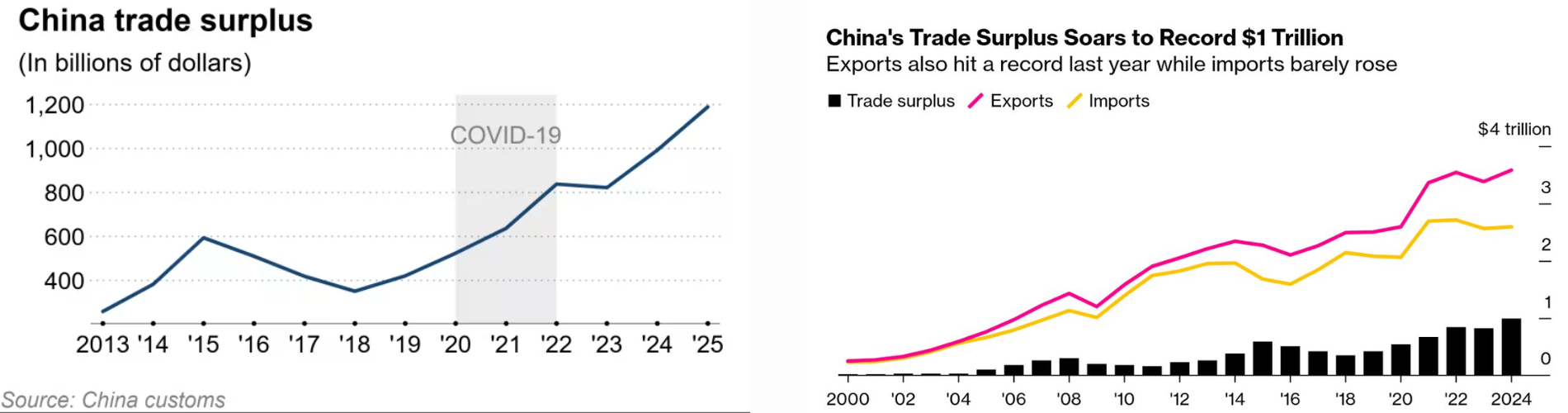

China’s Economy Slows but Benefits From Stimulus

China’s economic growth is expected to:

- Ease to 4.9% in 2025

- Slow further to 4.4% in 2026

Both figures were revised up from June, reflecting:

- Additional fiscal stimulus

- Stronger exports to non-U.S. markets

- Government support for key industries

However, the World Bank still expects China’s long-term growth trend to moderate as structural challenges, such as an aging population and property sector weakness persist.

Global Growth Relies on a Narrow Set of Engines

One of the key takeaways from the report is that global growth is becoming increasingly concentrated.

A small number of economies, mainly advanced ones, are carrying a disproportionate share of global expansion. Meanwhile, many developing nations are falling behind.

This imbalance increases risks to the global economy by making it:

- More vulnerable to shocks in major economies

- Less inclusive

- More unequal

Without broader participation in growth, global progress on poverty reduction and development goals may stall.

Policy Implications: Gradual Easing, Structural Reform Needed

The World Bank’s outlook supports gradual policy easing in advanced economies, where inflation pressures have moderated and growth remains resilient.

However, for emerging markets, monetary policy alone will not be enough.

Structural Reforms Are Critical

The report emphasizes the need for deeper reforms, including:

- Improving productivity

- Strengthening institutions

- Expanding access to finance

- Investing in education and infrastructure

Without these changes, emerging economies may continue to experience limited upside, even if global conditions improve.

Conclusion: Resilient but Fragile Global Economy

The World Bank’s latest Global Economic Prospects report paints a nuanced picture of the global economy.

On one hand, growth has proven more resilient than feared, and near-term risks have eased. On the other, the world faces a prolonged period of weak and uneven growth, threatening long-term development and financial stability.

As the global economy navigates this “low-growth, high-resilience” era, the challenge for policymakers will be to convert resilience into renewed dynamism before stagnation becomes the new normal.